Page 218 - International Taxation IRS Training Guides

P. 218

Subpart

F Modifications:

Downward Attribution

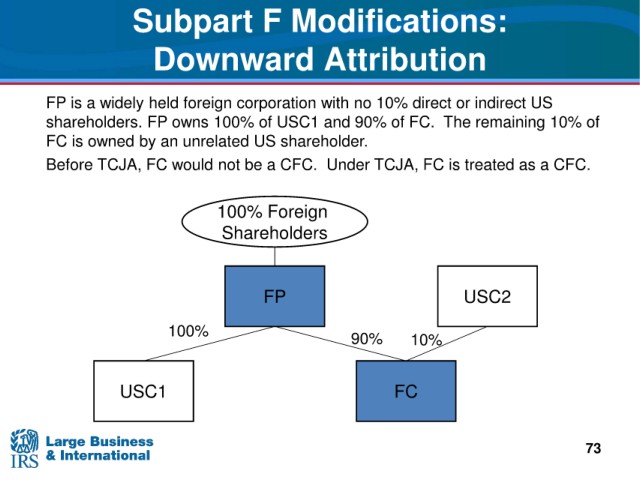

FP is a widely

held foreign corporation with no 10% direct or indirect US

shareholders. The remaining 10% of

FP owns 100% of USC1 and 90% of FC.

an unrelated US shareholder.

FC is owned by

Before TCJA, FC would not be a CFC. Under TCJA, FC is treated as a CFC.

Foreign

100%

Shareholders

FP USC2

100% 90% 10%

USC1 FC

73