Page 214 - International Taxation IRS Training Guides

P. 214

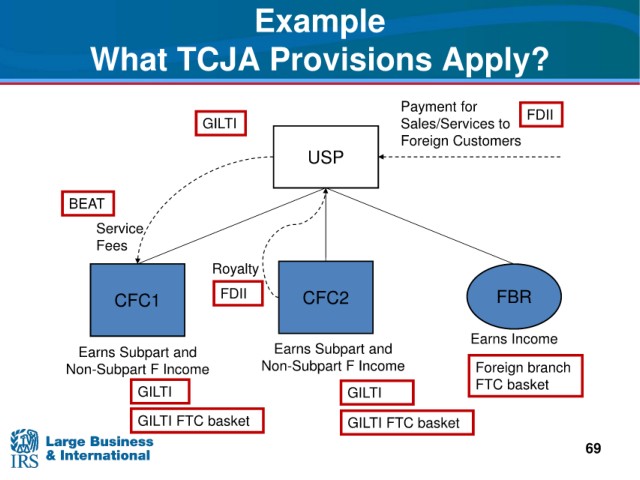

Example

What TCJA Provisions Apply?

Payment for FDII

GILTI

Sales/Services to

Foreign Customers

USP

BEAT

Service

Fees

Royalty

CFC1 FDII

CFC2 FBR

Earns Income

Earns Subpart and Earns Subpart and

Non-Subpart F Income Non-Subpart F Income Foreign branch

GILTI GILTI FTC basket

GILTI FTC basket GILTI FTC basket

69