Page 216 - International Taxation IRS Training Guides

P. 216

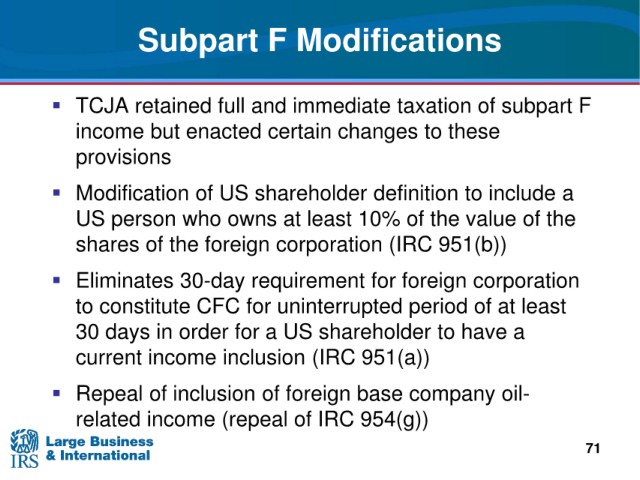

Subpart

F Modifications

and immediate taxation of subpart F

TCJA retained full

income but enacted certain changes

to these

provisions

Modification of US

shareholder definition to include a

person who owns at least 10% of the value of the

US

of the foreign corporation (IRC 951(b))

shares

Eliminates 30-day requirement for

foreign corporation

for uninterrupted period of at least

to constitute CFC

30 days in order for

a US shareholder to have a

current income inclusion (IRC 951(a))

Repeal of

inclusion of foreign base company oil-

related income (repeal of

IRC 954(g))

71