Page 219 - International Taxation IRS Training Guides

P. 219

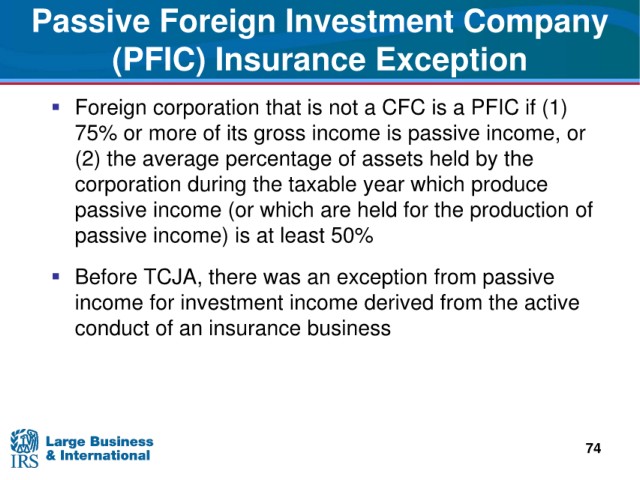

Passive Foreign

Investment Company

(PFIC)

Insurance Exception

Foreign corporation that

is not a CFC is a PFIC if (1)

75% or more of i t s

gross income is passive income, or

the

(2) the average percentage of assets held by

which produce

corporation during the taxable year

passive income (or which are held for the production of

is at least 50%

passive income)

there was an exception from passive

Before TCJA,

investment income derived from the active

income for

conduct of

an insurance business

74