Page 329 - International Taxation IRS Training Guides

P. 329

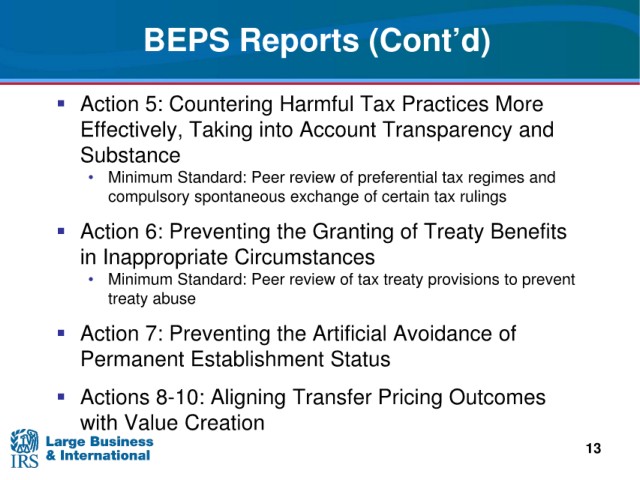

BEPS Reports (Cont’d)

Countering Harmful Tax Practices More

Action 5:

Taking into Account Transparency and

Effectively,

Substance

• Minimum Standard: Peer

review of preferential tax regimes and

compulsory

spontaneous exchange of certain tax rulings

Action 6: Preventing the Granting of Treaty Benefits

in Inappropriate Circumstances

• Minimum

Standard: Peer review of tax treaty provisions to prevent

treaty

abuse

Avoidance of

Action 7: Preventing the Artificial

Status

Permanent Establishment

Aligning Transfer Pricing Outcomes

Actions 8-10:

with Value Creation

13