Page 330 - International Taxation IRS Training Guides

P. 330

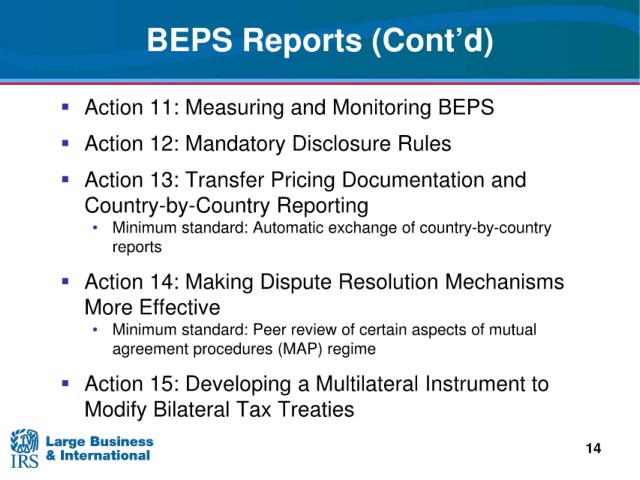

BEPS Reports (Cont’d)

Action 11: Measuring and Monitoring BEPS

Action 12: Mandatory Disclosure Rules

Pricing Documentation and

Action 13: Transfer

Country-by-Country Reporting

• Minimum standard: Automatic

exchange of country-by-country

reports

Action 14: Making Dispute Resolution Mechanisms

More Effective

standard: Peer review of certain aspects of mutual

• Minimum

procedures (MAP) regime

agreement

Instrument to

Action 15: Developing a Multilateral

Modify Bilateral

Tax Treaties

14