Page 61 - International Taxation IRS Training Guides

P. 61

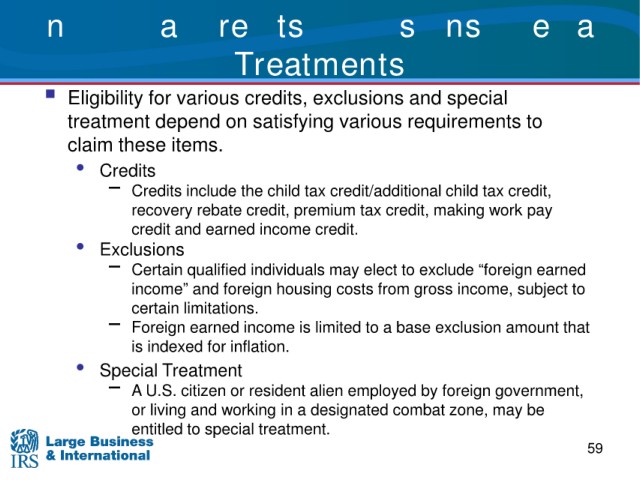

Individual Credits/Exclusions/Special

Treatments

for various credits, exclusions and special

Eligibility

requirements to

treatment depend on satisfying various

claim these items.

• Credits

− Credits

include the child tax credit/additional child tax credit,

recovery

rebate credit, premium tax credit, making work pay

and earned income credit.

credit

• Exclusions

elect to exclude “foreign earned

− Certain qualified individuals may

and foreign housing costs from gross income, subject to

income”

certain limitations.

limited to a base exclusion amount that

− Foreign earned income is

is indexed for inflation.

Treatment

• Special

− A U.S. citizen or resident alien employed by foreign government,

living and working in a designated combat zone, may be

or

entitled to special

treatment.

59