Page 66 - International Taxation IRS Training Guides

P. 66

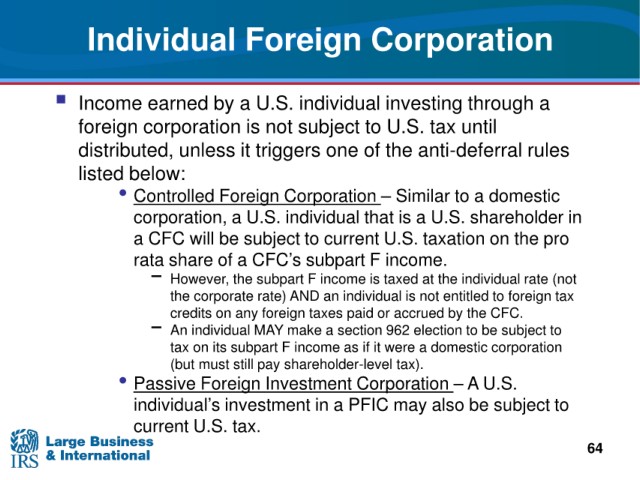

Individual Foreign Corporation

a U.S. individual investing through a

Income earned by

not subject to U.S. tax until

foreign corporation i s

it triggers one of the anti-deferral rules

distributed, unless

listed below:

• Controlled Foreign Corporation – Similar to a domestic

corporation, a U.S. individual that is a U.S. shareholder in

a CFC will be subject to current U.S. taxation on the pro

rata share of a CFC’s subpart F income.

− However, the subpart F income is taxed at the individual rate (not

AND an individual is not entitled to foreign tax

the corporate rate)

foreign taxes paid or accrued by the CFC.

credits on any

− An individual MAY

make a section 962 election to be subject to

tax on its subpart F income as if it were a domestic corporation

(but must still pay

shareholder-level tax).

• Passive

Foreign Investment Corporation – A U.S.

investment in a PFIC may also be subject to

individual’s

U.S. tax.

current

64