Page 68 - Calculating Lost Profits

P. 68

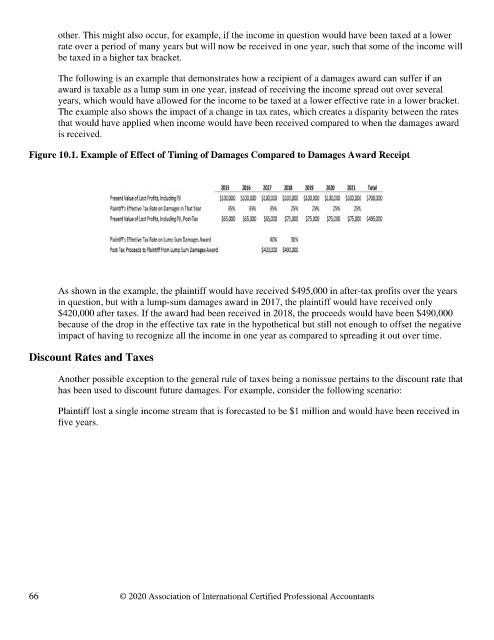

other. This might also occur, for example, if the income in question would have been taxed at a lower

rate over a period of many years but will now be received in one year, such that some of the income will

be taxed in a higher tax bracket.

The following is an example that demonstrates how a recipient of a damages award can suffer if an

award is taxable as a lump sum in one year, instead of receiving the income spread out over several

years, which would have allowed for the income to be taxed at a lower effective rate in a lower bracket.

The example also shows the impact of a change in tax rates, which creates a disparity between the rates

that would have applied when income would have been received compared to when the damages award

is received.

Figure 10.1. Example of Effect of Timing of Damages Compared to Damages Award Receipt

As shown in the example, the plaintiff would have received $495,000 in after-tax profits over the years

in question, but with a lump-sum damages award in 2017, the plaintiff would have received only

$420,000 after taxes. If the award had been received in 2018, the proceeds would have been $490,000

because of the drop in the effective tax rate in the hypothetical but still not enough to offset the negative

impact of having to recognize all the income in one year as compared to spreading it out over time.

Discount Rates and Taxes

Another possible exception to the general rule of taxes being a nonissue pertains to the discount rate that

has been used to discount future damages. For example, consider the following scenario:

Plaintiff lost a single income stream that is forecasted to be $1 million and would have been received in

five years.

66 © 2020 Association of International Certified Professional Accountants