Page 59 - Tax Reform

P. 59

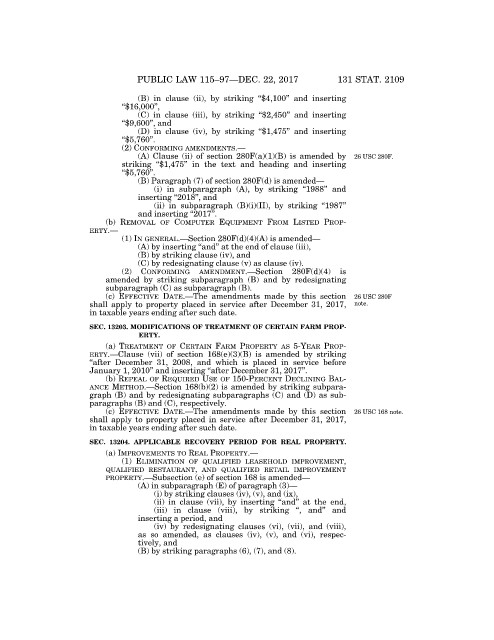

PUBLIC LAW 115–97—DEC. 22, 2017 131 STAT. 2109

(B) in clause (ii), by striking ‘‘$4,100’’ and inserting

‘‘$16,000’’,

(C) in clause (iii), by striking ‘‘$2,450’’ and inserting

‘‘$9,600’’, and

(D) in clause (iv), by striking ‘‘$1,475’’ and inserting

‘‘$5,760’’.

(2) CONFORMING AMENDMENTS.—

(A) Clause (ii) of section 280F(a)(1)(B) is amended by 26 USC 280F.

striking ‘‘$1,475’’ in the text and heading and inserting

‘‘$5,760’’.

(B) Paragraph (7) of section 280F(d) is amended—

(i) in subparagraph (A), by striking ‘‘1988’’ and

inserting ‘‘2018’’, and

(ii) in subparagraph (B)(i)(II), by striking ‘‘1987’’

and inserting ‘‘2017’’.

(b) REMOVAL OF COMPUTER EQUIPMENT FROM LISTED PROP-

ERTY.—

(1) IN GENERAL.—Section 280F(d)(4)(A) is amended—

(A) by inserting ‘‘and’’ at the end of clause (iii),

(B) by striking clause (iv), and

(C) by redesignating clause (v) as clause (iv).

(2) CONFORMING AMENDMENT.—Section 280F(d)(4) is

amended by striking subparagraph (B) and by redesignating

subparagraph (C) as subparagraph (B).

(c) EFFECTIVE DATE.—The amendments made by this section 26 USC 280F

shall apply to property placed in service after December 31, 2017, note.

in taxable years ending after such date.

SEC. 13203. MODIFICATIONS OF TREATMENT OF CERTAIN FARM PROP-

ERTY.

(a) TREATMENT OF CERTAIN FARM PROPERTY AS 5-YEAR PROP-

ERTY.—Clause (vii) of section 168(e)(3)(B) is amended by striking

‘‘after December 31, 2008, and which is placed in service before

January 1, 2010’’ and inserting ‘‘after December 31, 2017’’.

(b) REPEAL OF REQUIRED USE OF 150-PERCENT DECLINING BAL-

ANCE METHOD.—Section 168(b)(2) is amended by striking subpara-

graph (B) and by redesignating subparagraphs (C) and (D) as sub-

paragraphs (B) and (C), respectively.

(c) EFFECTIVE DATE.—The amendments made by this section 26 USC 168 note.

shall apply to property placed in service after December 31, 2017,

in taxable years ending after such date.

SEC. 13204. APPLICABLE RECOVERY PERIOD FOR REAL PROPERTY.

(a) IMPROVEMENTS TO REAL PROPERTY.—

(1) ELIMINATION OF QUALIFIED LEASEHOLD IMPROVEMENT,

QUALIFIED RESTAURANT, AND QUALIFIED RETAIL IMPROVEMENT

PROPERTY.—Subsection (e) of section 168 is amended—

(A) in subparagraph (E) of paragraph (3)—

(i) by striking clauses (iv), (v), and (ix),

(ii) in clause (vii), by inserting ‘‘and’’ at the end,

(iii) in clause (viii), by striking ‘‘, and’’ and

inserting a period, and

(iv) by redesignating clauses (vi), (vii), and (viii),

as so amended, as clauses (iv), (v), and (vi), respec-

dkrause on DSKBC28HB2PROD with PUBLAWS VerDate Sep 11 2014 10:09 Oct 18, 2018 Jkt 079139 PO 00097 Frm 00057 Fmt 6580 Sfmt 6581 E:\PUBLAW\PUBL097.115 PUBL097

tively, and

(B) by striking paragraphs (6), (7), and (8).