Page 63 - Tax Reform

P. 63

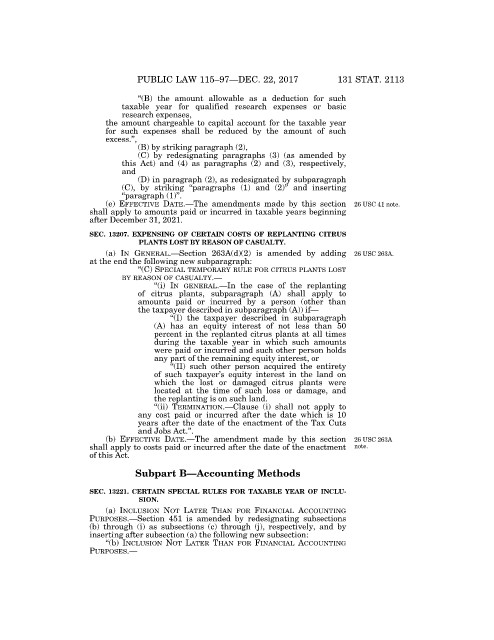

PUBLIC LAW 115–97—DEC. 22, 2017 131 STAT. 2113

‘‘(B) the amount allowable as a deduction for such

taxable year for qualified research expenses or basic

research expenses,

the amount chargeable to capital account for the taxable year

for such expenses shall be reduced by the amount of such

excess.’’,

(B) by striking paragraph (2),

(C) by redesignating paragraphs (3) (as amended by

this Act) and (4) as paragraphs (2) and (3), respectively,

and

(D) in paragraph (2), as redesignated by subparagraph

(C), by striking ‘‘paragraphs (1) and (2)’’ and inserting

‘‘paragraph (1)’’.

(e) EFFECTIVE DATE.—The amendments made by this section 26 USC 41 note.

shall apply to amounts paid or incurred in taxable years beginning

after December 31, 2021.

SEC. 13207. EXPENSING OF CERTAIN COSTS OF REPLANTING CITRUS

PLANTS LOST BY REASON OF CASUALTY.

(a) IN GENERAL.—Section 263A(d)(2) is amended by adding 26 USC 263A.

at the end the following new subparagraph:

‘‘(C) SPECIAL TEMPORARY RULE FOR CITRUS PLANTS LOST

BY REASON OF CASUALTY.—

‘‘(i) IN GENERAL.—In the case of the replanting

of citrus plants, subparagraph (A) shall apply to

amounts paid or incurred by a person (other than

the taxpayer described in subparagraph (A)) if—

‘‘(I) the taxpayer described in subparagraph

(A) has an equity interest of not less than 50

percent in the replanted citrus plants at all times

during the taxable year in which such amounts

were paid or incurred and such other person holds

any part of the remaining equity interest, or

‘‘(II) such other person acquired the entirety

of such taxpayer’s equity interest in the land on

which the lost or damaged citrus plants were

located at the time of such loss or damage, and

the replanting is on such land.

‘‘(ii) TERMINATION.—Clause (i) shall not apply to

any cost paid or incurred after the date which is 10

years after the date of the enactment of the Tax Cuts

and Jobs Act.’’.

(b) EFFECTIVE DATE.—The amendment made by this section 26 USC 263A

shall apply to costs paid or incurred after the date of the enactment note.

of this Act.

Subpart B—Accounting Methods

SEC. 13221. CERTAIN SPECIAL RULES FOR TAXABLE YEAR OF INCLU-

SION.

(a) INCLUSION NOT LATER THAN FOR FINANCIAL ACCOUNTING

PURPOSES.—Section 451 is amended by redesignating subsections

(b) through (i) as subsections (c) through (j), respectively, and by

inserting after subsection (a) the following new subsection:

dkrause on DSKBC28HB2PROD with PUBLAWS VerDate Sep 11 2014 10:09 Oct 18, 2018 Jkt 079139 PO 00097 Frm 00061 Fmt 6580 Sfmt 6581 E:\PUBLAW\PUBL097.115 PUBL097

‘‘(b) INCLUSION NOT LATER THAN FOR FINANCIAL ACCOUNTING

PURPOSES.—