Page 12 - IRS Plan

P. 12

Part III

Part I Part II Obj 1 Obj 2 Obj 3 Obj 4 Obj 5 Part IV Part V

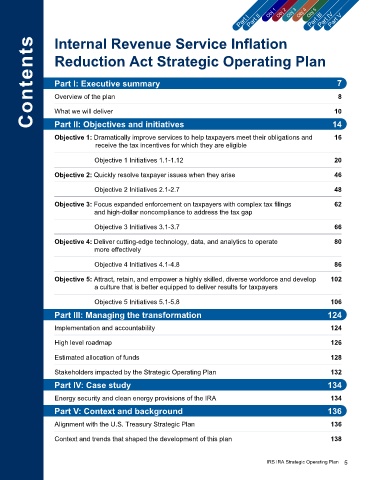

Contents Reduction Act Strategic Operating Plan 7

Internal Revenue Service Inflation

Part I: Executive summary

8

Overview of the plan

10

What we will deliver

Part II: Objectives and initiatives

16

Objective 1: Dramatically improve services to help taxpayers meet their obligations and 14

receive the tax incentives for which they are eligible

Objective 1 Initiatives 1.1-1.12 20

Objective 2: Quickly resolve taxpayer issues when they arise 46

Objective 2 Initiatives 2.1-2.7 48

Objective 3: Focus expanded enforcement on taxpayers with complex tax filings 62

and high-dollar noncompliance to address the tax gap

Objective 3 Initiatives 3.1-3.7 66

Objective 4: Deliver cutting-edge technology, data, and analytics to operate 80

more effectively

Objective 4 Initiatives 4.1-4.8 86

Objective 5: Attract, retain, and empower a highly skilled, diverse workforce and develop 102

a culture that is better equipped to deliver results for taxpayers

Objective 5 Initiatives 5.1-5.8 106

Part III: Managing the transformation 124

Implementation and accountability 124

High level roadmap 126

Estimated allocation of funds 128

Stakeholders impacted by the Strategic Operating Plan 132

Part IV: Case study 134

Energy security and clean energy provisions of the IRA 134

Part V: Context and background 136

Alignment with the U.S. Treasury Strategic Plan 136

Context and trends that shaped the development of this plan 138

IRS IRA Strategic Operating Plan 5