Page 38 - IRS Individual Tax Forms

P. 38

Form 4506T-EZ (Rev. 6-2019) Page 2

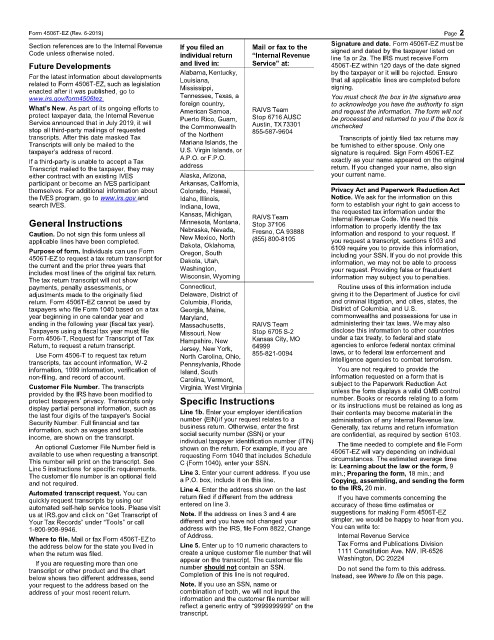

Section references are to the Internal Revenue If you filed an Mail or fax to the Signature and date. Form 4506T-EZ must be

Code unless otherwise noted. individual return “Internal Revenue signed and dated by the taxpayer listed on

line 1a or 2a. The IRS must receive Form

Future Developments and lived in: Service” at: 4506T-EZ within 120 days of the date signed

For the latest information about developments Alabama, Kentucky, by the taxpayer or it will be rejected. Ensure

that all applicable lines are completed before

related to Form 4506T-EZ, such as legislation Louisiana, signing.

enacted after it was published, go to Mississippi,

www.irs.gov/form4506tez. Tennessee, Texas, a You must check the box in the signature area

What’s New. As part of its ongoing efforts to foreign country, RAIVS Team to acknowledge you have the authority to sign

American Samoa,

protect taxpayer data, the Internal Revenue Stop 6716 AUSC and request the information. The form will not

Service announced that in July 2019, it will Puerto Rico, Guam, Austin, TX73301 be processed and returned to you if the box is

stop all third-party mailings of requested the Commonwealth 855-587-9604 unchecked

transcripts. After this date masked Tax of the Northern Transcripts of jointly filed tax returns may

Transcripts will only be mailed to the Mariana Islands, the be furnished to either spouse. Only one

taxpayer’s address of record. U.S. Virgin Islands, or signature is required. Sign Form 4506T-EZ

If a third-party is unable to accept a Tax A.P.O. or F.P.O. exactly as your name appeared on the original

Transcript mailed to the taxpayer, they may address return. If you changed your name, also sign

either contract with an existing IVES Alaska, Arizona, your current name.

participant or become an IVES participant Arkansas, California,

themselves. For additional information about Colorado, Hawaii, Privacy Act and Paperwork Reduction Act

the IVES program, go to www.irs.gov and Idaho, Illinois, Notice. We ask for the information on this

search IVES. Indiana, Iowa, form to establish your right to gain access to

Kansas, Michigan, RAIVSTeam the requested tax information under the

General Instructions Minnesota, Montana, Stop 37106 Internal Revenue Code. We need this

information to properly identify the tax

Caution. Do not sign this form unless all Nebraska, Nevada, Fresno, CA 93888 information and respond to your request. If

New Mexico, North

applicable lines have been completed. Dakota, Oklahoma, (855) 800-8105 you request a transcript, sections 6103 and

Purpose of form. Individuals can use Form Oregon, South 6109 require you to provide this information,

4506T-EZ to request a tax return transcript for Dakota, Utah, including your SSN. If you do not provide this

the current and the prior three years that Washington, information, we may not be able to process

includes most lines of the original tax return. Wisconsin, Wyoming your request. Providing false or fraudulent

The tax return transcript will not show information may subject you to penalties.

payments, penalty assessments, or Connecticut, Routine uses of this information include

adjustments made to the originally filed Delaware, District of giving it to the Department of Justice for civil

return. Form 4506T-EZ cannot be used by Columbia, Florida, and criminal litigation, and cities, states, the

taxpayers who file Form 1040 based on a tax Georgia, Maine, District of Columbia, and U.S.

year beginning in one calendar year and Maryland, commonwealths and possessions for use in

ending in the following year (fiscal tax year). Massachusetts, RAIVS Team administering their tax laws. We may also

Taxpayers using a fiscal tax year must file Missouri, New Stop 6705 S-2 disclose this information to other countries

Form 4506-T, Request for Transcript of Tax Hampshire, New Kansas City, MO under a tax treaty, to federal and state

Return, to request a return transcript. Jersey, New York, 64999 agencies to enforce federal nontax criminal

Use Form 4506-T to request tax return North Carolina, Ohio, 855-821-0094 laws, or to federal law enforcement and

transcripts, tax account information, W-2 Pennsylvania, Rhode intelligence agencies to combat terrorism.

information, 1099 information, verification of Island, South You are not required to provide the

non-filing, and record of account. Carolina, Vermont, information requested on a form that is

Customer File Number. The transcripts Virginia, West Virginia subject to the Paperwork Reduction Act

provided by the IRS have been modified to unless the form displays a valid OMB control

protect taxpayers’ privacy. Transcripts only Specific Instructions number. Books or records relating to a form

display partial personal information, such as Line 1b. Enter your employer identification or its instructions must be retained as long as

the last four digits of the taxpayer's Social number (EIN) if your request relates to a their contents may become material in the

Security Number. Full financial and tax business return. Otherwise, enter the first administration of any Internal Revenue law.

information, such as wages and taxable social security number (SSN) or your Generally, tax returns and return information

income, are shown on the transcript. individual taxpayer identification number (ITIN) are confidential, as required by section 6103.

An optional Customer File Number field is shown on the return. For example, if you are The time needed to complete and file Form

available to use when requesting a transcript. requesting Form 1040 that includes Schedule 4506T-EZ will vary depending on individual

This number will print on the transcript. See C (Form 1040), enter your SSN. circumstances. The estimated average time

Line 5 instructions for specific requirements. Line 3. Enter your current address. If you use is: Learning about the law or the form, 9

The customer file number is an optional field a P.O. box, include it on this line. min.; Preparing the form, 18 min.; and

and not required. Copying, assembling, and sending the form

to the IRS, 20 min.

Automated transcript request. You can Line 4. Enter the address shown on the last

return filed if different from the address

quickly request transcripts by using our entered on line 3. If you have comments concerning the

automated self-help service tools. Please visit accuracy of these time estimates or

us at IRS.gov and click on “Get Transcript of Note. If the address on lines 3 and 4 are suggestions for making Form 4506T-EZ

Your Tax Records” under “Tools” or call different and you have not changed your simpler, we would be happy to hear from you.

1-800-908-9946. address with the IRS, file Form 8822, Change You can write to:

Where to file. Mail or fax Form 4506T-EZ to of Address. Internal Revenue Service

the address below for the state you lived in Line 5. Enter up to 10 numeric characters to Tax Forms and Publications Division

when the return was filed. create a unique customer file number that will 1111 Constitution Ave. NW, IR-6526

Washington, DC 20224

If you are requesting more than one appear on the transcript. The customer file

number should not contain an SSN.

transcript or other product and the chart Completion of this line is not required. Do not send the form to this address.

below shows two different addresses, send Instead, see Where to file on this page.

your request to the address based on the Note. If you use an SSN, name or

address of your most recent return. combination of both, we will not input the

information and the customer file number will

reflect a generic entry of “9999999999” on the

transcript.