Page 41 - IRS Individual Tax Forms

P. 41

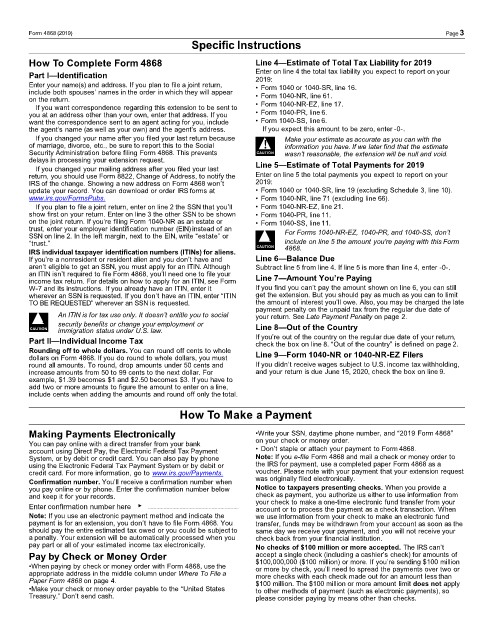

Form 4868 (2019) Page3

Specific Instructions

How To Complete Form 4868 Line 4—Estimate of Total Tax Liability for 2019

Part I—Identification Enter on line 4 the total tax liability you expect to report on your

2019:

Enter your name(s) and address. If you plan to file a joint return, • Form 1040 or 1040-SR, line 16.

include both spouses’ names in the order in which they will appear

on the return. • Form 1040-NR, line 61.

If you want correspondence regarding this extension to be sent to • Form 1040-NR-EZ, line 17.

you at an address other than your own, enter that address. If you • Form 1040-PR, line 6.

want the correspondence sent to an agent acting for you, include • Form 1040-SS, line 6.

the agent’s name (as well as your own) and the agent’s address. If you expect this amount to be zero, enter -0-.

If you changed your name after you filed your last return because Make your estimate as accurate as you can with the

of marriage, divorce, etc., be sure to report this to the Social ▲ ! information you have. If we later find that the estimate

Security Administration before filing Form 4868. This prevents CAUTION wasn’t reasonable, the extension will be null and void.

delays in processing your extension request.

If you changed your mailing address after you filed your last Line 5—Estimate of Total Payments for 2019

return, you should use Form 8822, Change of Address, to notify the Enter on line 5 the total payments you expect to report on your

IRS of the change. Showing a new address on Form 4868 won’t 2019:

update your record. You can download or order IRS forms at • Form 1040 or 1040-SR, line 19 (excluding Schedule 3, line 10).

www.irs.gov/FormsPubs. • Form 1040-NR, line 71 (excluding line 66).

If you plan to file a joint return, enter on line 2 the SSN that you’ll • Form 1040-NR-EZ, line 21.

show first on your return. Enter on line 3 the other SSN to be shown • Form 1040-PR, line 11.

on the joint return. If you’re filing Form 1040-NR as an estate or • Form 1040-SS, line 11.

trust, enter your employer identification number (EIN) instead of an

SSN on line 2. In the left margin, next to the EIN, write “estate” or ▲ ! For Forms 1040-NR-EZ, 1040-PR, and 1040-SS, don’t

“trust.” CAUTION include on line 5 the amount you’re paying with this Form

IRS individual taxpayer identification numbers (ITINs) for aliens. 4868.

If you’re a nonresident or resident alien and you don’t have and Line 6—Balance Due

aren’t eligible to get an SSN, you must apply for an ITIN. Although Subtract line 5 from line 4. If line 5 is more than line 4, enter -0-.

an ITIN isn’t required to file Form 4868, you’ll need one to file your

income tax return. For details on how to apply for an ITIN, see Form Line 7—Amount You’re Paying

W-7 and its instructions. If you already have an ITIN, enter it If you find you can’t pay the amount shown on line 6, you can still

wherever an SSN is requested. If you don’t have an ITIN, enter “ITIN get the extension. But you should pay as much as you can to limit

TO BE REQUESTED” wherever an SSN is requested. the amount of interest you’ll owe. Also, you may be charged the late

payment penalty on the unpaid tax from the regular due date of

▲ ! An ITIN is for tax use only. It doesn’t entitle you to social your return. See Late Payment Penalty on page 2.

security benefits or change your employment or

CAUTION immigration status under U.S. law. Line 8—Out of the Country

Part II—Individual Income Tax If you’re out of the country on the regular due date of your return,

check the box on line 8. “Out of the country” is defined on page 2.

Rounding off to whole dollars. You can round off cents to whole

dollars on Form 4868. If you do round to whole dollars, you must Line 9—Form 1040-NR or 1040-NR-EZ Filers

round all amounts. To round, drop amounts under 50 cents and If you didn’t receive wages subject to U.S. income tax withholding,

increase amounts from 50 to 99 cents to the next dollar. For and your return is due June 15, 2020, check the box on line 9.

example, $1.39 becomes $1 and $2.50 becomes $3. If you have to

add two or more amounts to figure the amount to enter on a line,

include cents when adding the amounts and round off only the total.

How To Make a Payment

Making Payments Electronically •Write your SSN, daytime phone number, and “2019 Form 4868”

You can pay online with a direct transfer from your bank on your check or money order.

account using Direct Pay, the Electronic Federal Tax Payment • Don’t staple or attach your payment to Form 4868.

System, or by debit or credit card. You can also pay by phone Note: If you e-file Form 4868 and mail a check or money order to

using the Electronic Federal Tax Payment System or by debit or the IRS for payment, use a completed paper Form 4868 as a

credit card. For more information, go to www.irs.gov/Payments. voucher. Please note with your payment that your extension request

Confirmation number. You’ll receive a confirmation number when was originally filed electronically.

you pay online or by phone. Enter the confirmation number below Notice to taxpayers presenting checks. When you provide a

and keep it for your records. check as payment, you authorize us either to use information from

Enter confirmation number here ▶ your check to make a one-time electronic fund transfer from your

account or to process the payment as a check transaction. When

Note: If you use an electronic payment method and indicate the we use information from your check to make an electronic fund

payment is for an extension, you don’t have to file Form 4868. You transfer, funds may be withdrawn from your account as soon as the

should pay the entire estimated tax owed or you could be subject to same day we receive your payment, and you will not receive your

a penalty. Your extension will be automatically processed when you check back from your financial institution.

pay part or all of your estimated income tax electronically. No checks of $100 million or more accepted. The IRS can’t

Pay by Check or Money Order accept a single check (including a cashier’s check) for amounts of

•When paying by check or money order with Form 4868, use the $100,000,000 ($100 million) or more. If you’re sending $100 million

or more by check, you’ll need to spread the payments over two or

appropriate address in the middle column under Where To File a more checks with each check made out for an amount less than

Paper Form 4868 on page 4. $100 million. The $100 million or more amount limit does not apply

•Make your check or money order payable to the “United States to other methods of payment (such as electronic payments), so

Treasury.” Don’t send cash. please consider paying by means other than checks.