Page 76 - Interest Income - Individuals

P. 76

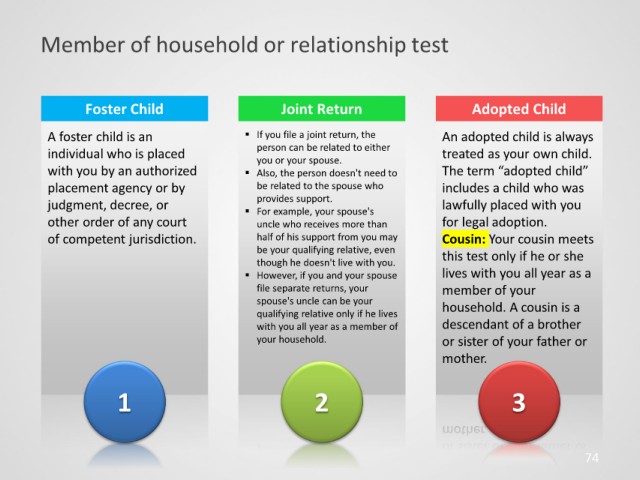

Member of household or relationship test

Foster Child Joint Return Adopted Child

A foster child is an If you file a joint return, the An adopted child is always

individual who is placed person can be related to either treated as your own child.

you or your spouse.

with you by an authorized Also, the person doesn't need to The term “adopted child”

placement agency or by be related to the spouse who includes a child who was

provides support.

judgment, decree, or For example, your spouse's lawfully placed with you

other order of any court uncle who receives more than for legal adoption.

of competent jurisdiction. half of his support from you may Cousin: Your cousin meets

be your qualifying relative, even this test only if he or she

though he doesn't live with you.

However, if you and your spouse lives with you all year as a

file separate returns, your member of your

spouse's uncle can be your household. A cousin is a

qualifying relative only if he lives

with you all year as a member of descendant of a brother

your household. or sister of your father or

mother.

1 2 3

74