Page 79 - Interest Income - Individuals

P. 79

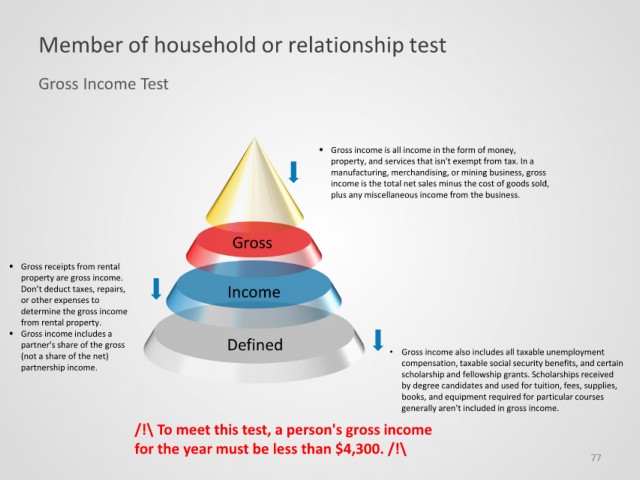

Member of household or relationship test

Gross Income Test

Gross income is all income in the form of money,

property, and services that isn't exempt from tax. In a

manufacturing, merchandising, or mining business, gross

income is the total net sales minus the cost of goods sold,

plus any miscellaneous income from the business.

Gross

Gross receipts from rental

property are gross income.

Don’t deduct taxes, repairs, Income

or other expenses to

determine the gross income

from rental property.

Gross income includes a

partner's share of the gross Defined

(not a share of the net) • Gross income also includes all taxable unemployment

partnership income. compensation, taxable social security benefits, and certain

scholarship and fellowship grants. Scholarships received

by degree candidates and used for tuition, fees, supplies,

books, and equipment required for particular courses

generally aren't included in gross income.

/!\ To meet this test, a person's gross income

for the year must be less than $4,300. /!\

77