Page 18 - M & A Disputes

P. 18

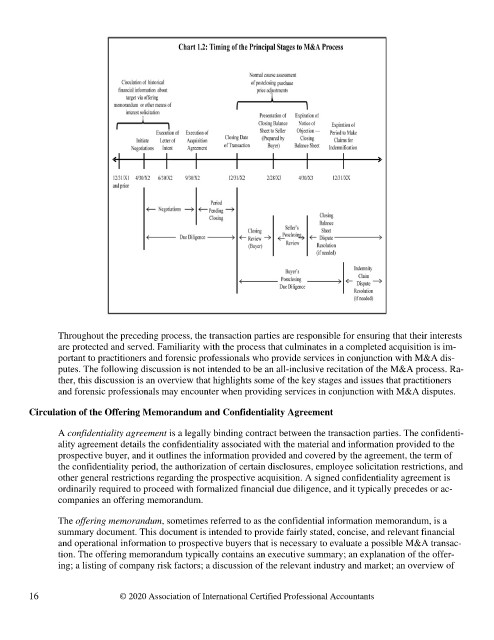

Throughout the preceding process, the transaction parties are responsible for ensuring that their interests

are protected and served. Familiarity with the process that culminates in a completed acquisition is im-

portant to practitioners and forensic professionals who provide services in conjunction with M&A dis-

putes. The following discussion is not intended to be an all-inclusive recitation of the M&A process. Ra-

ther, this discussion is an overview that highlights some of the key stages and issues that practitioners

and forensic professionals may encounter when providing services in conjunction with M&A disputes.

Circulation of the Offering Memorandum and Confidentiality Agreement

A confidentiality agreement is a legally binding contract between the transaction parties. The confidenti-

ality agreement details the confidentiality associated with the material and information provided to the

prospective buyer, and it outlines the information provided and covered by the agreement, the term of

the confidentiality period, the authorization of certain disclosures, employee solicitation restrictions, and

other general restrictions regarding the prospective acquisition. A signed confidentiality agreement is

ordinarily required to proceed with formalized financial due diligence, and it typically precedes or ac-

companies an offering memorandum.

The offering memorandum, sometimes referred to as the confidential information memorandum, is a

summary document. This document is intended to provide fairly stated, concise, and relevant financial

and operational information to prospective buyers that is necessary to evaluate a possible M&A transac-

tion. The offering memorandum typically contains an executive summary; an explanation of the offer-

ing; a listing of company risk factors; a discussion of the relevant industry and market; an overview of

16 © 2020 Association of International Certified Professional Accountants