Page 183 - Small Business IRS Training Guides

P. 183

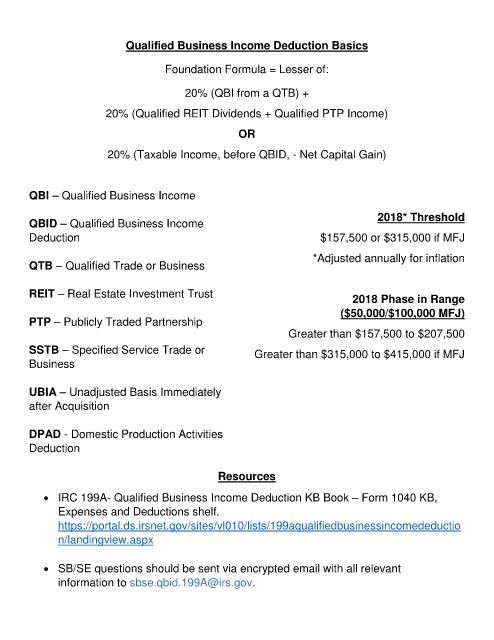

Qualified Business Income Deduction Basics

Foundation Formula = Lesser of:

20% (QBI from a QTB) +

20% (Qualified REIT Dividends + Qualified PTP Income)

OR

20% (Taxable Income, before QBID, - Net Capital Gain)

Qualified Business Income

QBI –

QBID – Qualified Business Income 2018* Threshold

Deduction $157,500 or $315,000 if MFJ

*Adjusted annually for inflation

QTB – Qualified Trade or Business

Real Estate Investment Trust

REIT – 2018 Phase in Range

($50,000/$100,000 MFJ)

PTP – Publicly Traded Partnership

Greater than $157,500 to $207,500

SSTB – Specified Service Trade or Greater than $315,000 to $415,000 if MFJ

Business

UBIA – Unadjusted Basis Immediately

after Acquisition

DPAD - Domestic Production Activities

Deduction

Resources

• IRC 199A- Qualified Business Income Deduction KB Book – Form 1040 KB,

Expenses and Deductions shelf.

https://portal.ds.irsnet.gov/sites/vl010/lists/199aqualifiedbusinessincomedeductio

n/landingview.aspx

• SB/SE questions should be sent via encrypted email with all relevant

information to sbse.qbid.199A@irs.gov.