Page 187 - Small Business IRS Training Guides

P. 187

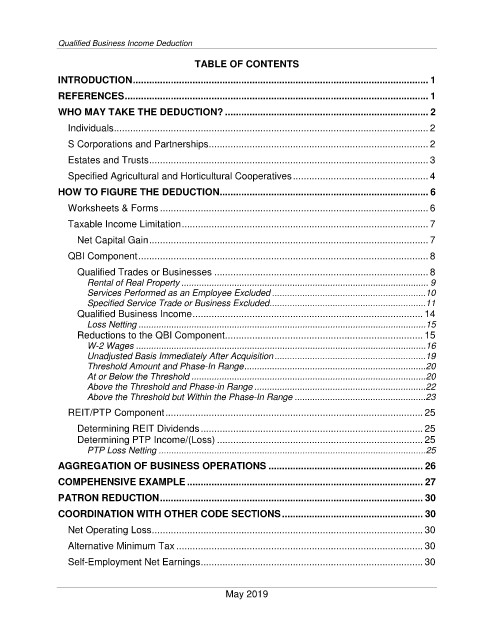

Qualified Business Income Deduction

TABLE OF CONTENTS

INTRODUCTION ............................................................................................................. 1

REFERENCES................................................................................................................ 1

WHO MAY TAKE THE DEDUCTION? ........................................................................... 2

Individuals.................................................................................................................... 2

S Corporations and Partnerships................................................................................. 2

Estates and Trusts....................................................................................................... 3

Specified Agricultural and Horticultural Cooperatives.................................................. 4

HOW TO FIGURE THE DEDUCTION............................................................................. 6

Worksheets & Forms ................................................................................................... 6

Taxable Income Limitation........................................................................................... 7

Net Capital Gain....................................................................................................... 7

QBI Component........................................................................................................... 8

Qualified Trades or Businesses ............................................................................... 8

Rental of Real Property .................................................................................................. 9

Services Performed as an Employee Excluded .............................................................10

Specified Service Trade or Business Excluded..............................................................11

Qualified Business Income ..................................................................................... 14

Loss Netting ..................................................................................................................15

Reductions to the QBI Component......................................................................... 15

W-2 Wages ...................................................................................................................16

Unadjusted Basis Immediately After Acquisition............................................................19

Threshold Amount and Phase-In Range........................................................................20

At or Below the Threshold .............................................................................................20

Above the Threshold and Phase-in Range ....................................................................22

Above the Threshold but Within the Phase-In Range ....................................................23

REIT/PTP Component ............................................................................................... 25

Determining REIT Dividends .................................................................................. 25

Determining PTP Income/(Loss) ............................................................................ 25

PTP Loss Netting ..........................................................................................................25

AGGREGATION OF BUSINESS OPERATIONS ......................................................... 26

COMPEHENSIVE EXAMPLE ....................................................................................... 27

PATRON REDUCTION................................................................................................. 30

COORDINATION WITH OTHER CODE SECTIONS .................................................... 30

Net Operating Loss.................................................................................................... 30

Alternative Minimum Tax ........................................................................................... 30

Self-Employment Net Earnings.................................................................................. 30

May 2019