Page 267 - Small Business IRS Training Guides

P. 267

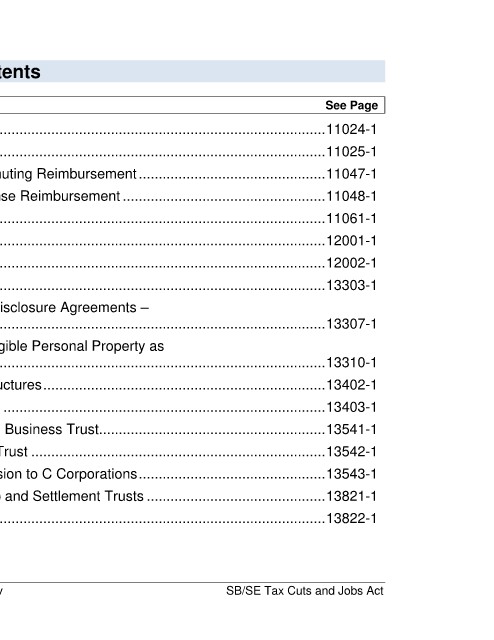

Contents

Provision, Title See Page

11024 – Increased Contributions to ABLE Accounts ................................................................................................ 11024-1

11025 – Rollovers to ABLE Programs from 529 Programs ....................................................................................... 11025-1

11047 – Suspension of Exclusion for Qualified Bicycle Commuting Reimbursement ............................................... 11047-1

11048 – Suspension of Exclusion for Qualified Moving Expense Reimbursement ................................................... 11048-1

11061 – Increase in Estate and Gift Tax Exemption ................................................................................................. 11061-1

12001 – Repeal of Corp Alt Min Tax ......................................................................................................................... 12001-1

12002 – Credit for Prior Year Min Tax Liability of Corp ............................................................................................. 12002-1

13303 – Like-Kind Exchanges of Real Property ........................................................................................................ 13303-1

13307 – Denial of Deduction for Settlements Subject to Nondisclosure Agreements –

Sexual Harassment/Abuse ......................................................................................................................... 13307-1

13310 – Prohibition on Cash, Gift Cards, and Other Non-Tangible Personal Property as

Employee Achievement Awards ................................................................................................................. 13310-1

13402 – Rehabilitation Credit Limited to Certified Historic Structures ....................................................................... 13402-1

13403 – Employer Credit For Paid Family and Medical Leave ................................................................................. 13403-1

13541 – Expansion of Qualifying Beneficiary – Electing Small Business Trust......................................................... 13541-1

13542 – Charitable Contributions – Electing Small Business Trust .......................................................................... 13542-1

13543 – Modification of Treatment of S Corporations Conversion to C Corporations ............................................... 13543-1

13821 – Modification of Tax Treatment of Alaska Native Corp and Settlement Trusts ............................................. 13821-1

13822 – Amounts Paid for Aircraft Management Services ........................................................................................ 13822-1

73223-102 v SB/SE Tax Cuts and Jobs Act