Page 270 - Small Business IRS Training Guides

P. 270

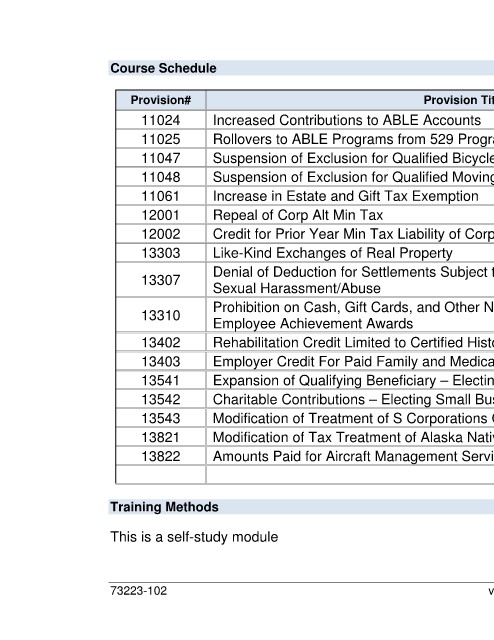

Course Schedule

Provision# Provision Title Time

11024 Increased Contributions to ABLE Accounts 15 minutes

11025 Rollovers to ABLE Programs from 529 Programs 15 minutes

11047 Suspension of Exclusion for Qualified Bicycle Commuting Reimbursement 15 minutes

11048 Suspension of Exclusion for Qualified Moving Expense Reimbursement 15 minutes

11061 Increase in Estate and Gift Tax Exemption 15 minutes

12001 Repeal of Corp Alt Min Tax 15 minutes

12002 Credit for Prior Year Min Tax Liability of Corp 15 minutes

13303 Like-Kind Exchanges of Real Property 15 minutes

Denial of Deduction for Settlements Subject to Nondisclosure Agreements –

13307 15 minutes

Sexual Harassment/Abuse

Prohibition on Cash, Gift Cards, and Other Non-Tangible Personal Property as

13310 15 minutes

Employee Achievement Awards

13402 Rehabilitation Credit Limited to Certified Historic Structures 15 minutes

13403 Employer Credit For Paid Family and Medical Leave 15 minutes

13541 Expansion of Qualifying Beneficiary – Electing Small Business Trust 15 minutes

13542 Charitable Contributions – Electing Small Business Trust 15 minutes

13543 Modification of Treatment of S Corporations Conversion to C Corporations 15 minutes

13821 Modification of Tax Treatment of Alaska Native Corp and Settlement Trusts 15 minutes

13822 Amounts Paid for Aircraft Management Services 15 minutes

Total Time 4 hours 15 minutes

Training Methods

This is a self-study module

73223-102 vii SB/SE Tax Cuts and Jobs Act