Page 89 - Supplement to Income Tax TY2021

P. 89

16:10 - 9-Feb-2021

Page 55 of 111

Fileid: … ions/I1040/2020/A/XML/Cycle09/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

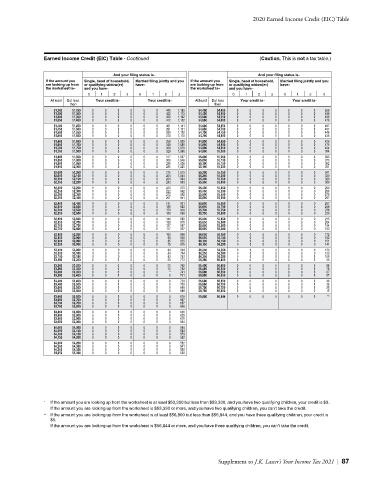

2020 Earned Income Credit (EIC) Table

Earned Income Credit (EIC) Table - Continued (Caution. This is not a tax table.)

And your filing status is– And your filing status is–

If the amount you Single, head of household, Married filing jointly and you If the amount you Single, head of household, Married filing jointly and you

are looking up from or qualifying widow(er) have– are looking up from or qualifying widow(er) have–

the worksheet is– and you have– the worksheet is– and you have–

0 1 2 3 0 1 2 3 0 1 2 3 0 1 2 3

At least But less Your credit is– Your credit is– At least But less Your credit is– Your credit is–

than than

51,200 51,250 0 0 0 0 0 0 443 1,183 54,400 54,450 0 0 0 0 0 0 0 509

51,250 51,300 0 0 0 0 0 0 433 1,173 54,450 54,500 0 0 0 0 0 0 0 499

51,300 51,350 0 0 0 0 0 0 422 1,162 54,500 54,550 0 0 0 0 0 0 0 488

51,350 51,400 0 0 0 0 0 0 412 1,152 54,550 54,600 0 0 0 0 0 0 0 478

51,400 51,450 0 0 0 0 0 0 401 1,141 54,600 54,650 0 0 0 0 0 0 0 467

51,450 51,500 0 0 0 0 0 0 391 1,131 54,650 54,700 0 0 0 0 0 0 0 457

51,500 51,550 0 0 0 0 0 0 380 1,120 54,700 54,750 0 0 0 0 0 0 0 446

51,550 51,600 0 0 0 0 0 0 370 1,110 54,750 54,800 0 0 0 0 0 0 0 436

51,600 51,650 0 0 0 0 0 0 359 1,099 54,800 54,850 0 0 0 0 0 0 0 425

51,650 51,700 0 0 0 0 0 0 349 1,089 54,850 54,900 0 0 0 0 0 0 0 415

51,700 51,750 0 0 0 0 0 0 338 1,078 54,900 54,950 0 0 0 0 0 0 0 404

51,750 51,800 0 0 0 0 0 0 328 1,068 54,950 55,000 0 0 0 0 0 0 0 394

51,800 51,850 0 0 0 0 0 0 317 1,057 55,000 55,050 0 0 0 0 0 0 0 383

51,850 51,900 0 0 0 0 0 0 306 1,046 55,050 55,100 0 0 0 0 0 0 0 373

51,900 51,950 0 0 0 0 0 0 296 1,036 55,100 55,150 0 0 0 0 0 0 0 362

51,950 52,000 0 0 0 0 0 0 285 1,025 55,150 55,200 0 0 0 0 0 0 0 351

52,000 52,050 0 0 0 0 0 0 275 1,015 55,200 55,250 0 0 0 0 0 0 0 341

52,050 52,100 0 0 0 0 0 0 264 1,004 55,250 55,300 0 0 0 0 0 0 0 330

52,100 52,150 0 0 0 0 0 0 254 994 55,300 55,350 0 0 0 0 0 0 0 320

52,150 52,200 0 0 0 0 0 0 243 983 55,350 55,400 0 0 0 0 0 0 0 309

52,200 52,250 0 0 0 0 0 0 233 973 55,400 55,450 0 0 0 0 0 0 0 299

52,250 52,300 0 0 0 0 0 0 222 962 55,450 55,500 0 0 0 0 0 0 0 288

52,300 52,350 0 0 0 0 0 0 212 952 55,500 55,550 0 0 0 0 0 0 0 278

52,350 52,400 0 0 0 0 0 0 201 941 55,550 55,600 0 0 0 0 0 0 0 267

52,400 52,450 0 0 0 0 0 0 191 931 55,600 55,650 0 0 0 0 0 0 0 257

52,450 52,500 0 0 0 0 0 0 180 920 55,650 55,700 0 0 0 0 0 0 0 246

52,500 52,550 0 0 0 0 0 0 170 910 55,700 55,750 0 0 0 0 0 0 0 236

52,550 52,600 0 0 0 0 0 0 159 899 55,750 55,800 0 0 0 0 0 0 0 225

52,600 52,650 0 0 0 0 0 0 149 889 55,800 55,850 0 0 0 0 0 0 0 215

52,650 52,700 0 0 0 0 0 0 138 878 55,850 55,900 0 0 0 0 0 0 0 204

52,700 52,750 0 0 0 0 0 0 127 867 55,900 55,950 0 0 0 0 0 0 0 194

52,750 52,800 0 0 0 0 0 0 117 857 55,950 56,000 0 0 0 0 0 0 0 183

52,800 52,850 0 0 0 0 0 0 106 846 56,000 56,050 0 0 0 0 0 0 0 172

52,850 52,900 0 0 0 0 0 0 96 836 56,050 56,100 0 0 0 0 0 0 0 162

52,900 52,950 0 0 0 0 0 0 85 825 56,100 56,150 0 0 0 0 0 0 0 151

52,950 53,000 0 0 0 0 0 0 75 815 56,150 56,200 0 0 0 0 0 0 0 141

53,000 53,050 0 0 0 0 0 0 64 804 56,200 56,250 0 0 0 0 0 0 0 130

53,050 53,100 0 0 0 0 0 0 54 794 56,250 56,300 0 0 0 0 0 0 0 120

53,100 53,150 0 0 0 0 0 0 43 783 56,300 56,350 0 0 0 0 0 0 0 109

53,150 53,200 0 0 0 0 0 0 33 773 56,350 56,400 0 0 0 0 0 0 0 99

53,200 53,250 0 0 0 0 0 0 22 762 56,400 56,450 0 0 0 0 0 0 0 88

53,250 53,300 0 0 0 0 0 0 12 752 56,450 56,500 0 0 0 0 0 0 0 78

53,300 53,350 0 0 0 0 0 0 * 741 56,500 56,550 0 0 0 0 0 0 0 67

53,350 53,400 0 0 0 0 0 0 0 731 56,550 56,600 0 0 0 0 0 0 0 57

53,400 53,450 0 0 0 0 0 0 0 720 56,600 56,650 0 0 0 0 0 0 0 46

53,450 53,500 0 0 0 0 0 0 0 709 56,650 56,700 0 0 0 0 0 0 0 36

53,500 53,550 0 0 0 0 0 0 0 699 56,700 56,750 0 0 0 0 0 0 0 25

53,550 53,600 0 0 0 0 0 0 0 688 56,750 56,800 0 0 0 0 0 0 0 15

53,600 53,650 0 0 0 0 0 0 0 678 56,800 56,844 0 0 0 0 0 0 0 **

53,650 53,700 0 0 0 0 0 0 0 667

53,700 53,750 0 0 0 0 0 0 0 657

53,750 53,800 0 0 0 0 0 0 0 646

53,800 53,850 0 0 0 0 0 0 0 636

53,850 53,900 0 0 0 0 0 0 0 625

53,900 53,950 0 0 0 0 0 0 0 615

53,950 54,000 0 0 0 0 0 0 0 604

54,000 54,050 0 0 0 0 0 0 0 594

54,050 54,100 0 0 0 0 0 0 0 583

54,100 54,150 0 0 0 0 0 0 0 573

54,150 54,200 0 0 0 0 0 0 0 562

54,200 54,250 0 0 0 0 0 0 0 552

54,250 54,300 0 0 0 0 0 0 0 541

54,300 54,350 0 0 0 0 0 0 0 530

54,350 54,400 0 0 0 0 0 0 0 520

* If the amount you are looking up from the worksheet is at least $53,300 but less than $53,330, and you have two qualifying children, your credit is $3.

If the amount you are looking up from the worksheet is $53,330 or more, and you have two qualifying children, you can't take the credit.

** If the amount you are looking up from the worksheet is at least $56,800 but less than $56,844, and you have three qualifying children, your credit is

$5.

If the amount you are looking up from the worksheet is $56,844 or more, and you have three qualifying children, you can’t take the credit.

Supplement to J.K. Lasser’s Your Income Tax 2021 | 87