Page 19 - ForeclosurePreventionGuide_Final _Neat

P. 19

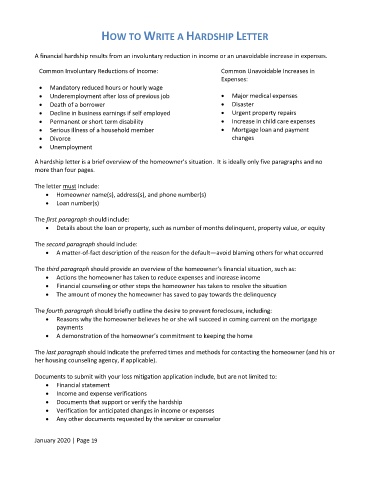

HOW TO WRITE A HARDSHIP LETTER

A financial hardship results from an involuntary reduction in income or an unavoidable increase in expenses.

Common Involuntary Reductions of Income: Common Unavoidable Increases in

Expenses:

• Mandatory reduced hours or hourly wage

• Underemployment after loss of previous job • Major medical expenses

• Death of a borrower • Disaster

• Decline in business earnings if self employed • Urgent property repairs

• Permanent or short term disability • Increase in child care expenses

• Serious illness of a household member • Mortgage loan and payment

• Divorce changes

• Unemployment

Unavoidable Increases in Expenses:

A hardship letter is a brief overview of the homeowner’s situation. It is ideally only five paragraphs and no

more than four pages.

• Major Medical Expenses

• Disaster

The letter must include:

• Urgent Property Repairs

• Homeowner name(s), address(s), and phone number(s)

• Increase in child care expenses

• Loan number(s)

• Mortgage loan and payment changes

The first paragraph should include:

• Details about the loan or property, such as number of months delinquent, property value, or equity

The second paragraph should include:

• A matter-of-fact description of the reason for the default—avoid blaming others for what occurred

The third paragraph should provide an overview of the homeowner’s financial situation, such as:

• Actions the homeowner has taken to reduce expenses and increase income

• Financial counseling or other steps the homeowner has taken to resolve the situation

• The amount of money the homeowner has saved to pay towards the delinquency

The fourth paragraph should briefly outline the desire to prevent foreclosure, including:

• Reasons why the homeowner believes he or she will succeed in coming current on the mortgage

payments

• A demonstration of the homeowner’s commitment to keeping the home

The last paragraph should indicate the preferred times and methods for contacting the homeowner (and his or

her housing counseling agency, if applicable).

Documents to submit with your loss mitigation application include, but are not limited to:

• Financial statement

• Income and expense verifications

• Documents that support or verify the hardship

• Verification for anticipated changes in income or expenses

• Any other documents requested by the servicer or counselor

January 2020 | Page 19