Page 67 - Arthyog_FilBook_05 05 2024 (1)

P. 67

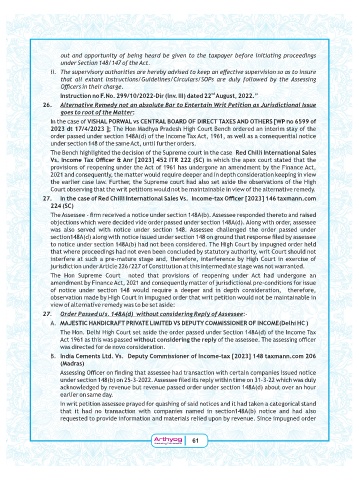

out and opportunity of being heard be given to the taxpayer before initiating proceedings

under Section 148/147 of the Act.

ii. The supervisory authorities are hereby advised to keep an effective supervision so as to insure

that all extant Instructions/Guidelines/Circulars/SOPs are duly followed by the Assessing

Officers in their charge.

nd

Instruction no F.No. 299/10/2022-Dir (lnv. III) dated 22 August, 2022.”

26. Alternative Remedy not an absolute Bar to Entertain Writ Petition as Jurisdictional Issue

goes to root of the Matter:

( . VISHAL PORWAL vs CENTRAL BOARD OF DIRECT TAXES AND OTHERS [WP no 6599 of

2023 dt 17/4/2023 ]; 8 8 % ) ! .

& #+' * . ( ! / + R 1 :

# . ! + .

% % . & ! Red Chilli International Sales

Vs. Income Tax Officer & Anr [2023] 452 ITR 222 (SC) 1 & /

& " . & % + . R % ! ! < +

=$= : ! 1 : & & & % " 1

1 < & ! " . 8 %

) " % 1 & 1 ! " 1 . " !

27. In the case of Red Chilli International Sales Vs. Income-tax Officer [2023] 146 taxmann.com

224 (SC)

+ ; ? ! " #+' * + &

@ 1 1 " & #+' * + % 1

1 " 1 # + % &

#+' * % 1 # % & ?

#+' * 8 % ) !& %

1 & % " 1 )

. & ;! % . . 8 % ) / .

@ + ==RI== . ) ! % 1 1

8 & ! ) & " . & % + %

! ! < + =$= : ! . @ & ; .

. # 1 : & & .

" ! 8 % ) !& % 1 & 1 !

" 1 . " ! 1 G

27. Order Passed u/s. 148A(d) without considering Reply of Assessee:;

+ MAJESTIC HANDICRAFT PRIVATE LIMITED VS DEPUTY COMMISSIONER OF INCOME(Delhi HC )

8 A 8 % ) & #+' * . ( ! /

+ R 1 & without considering the reply . % F

1 . "

India Cements Ltd. Vs. Deputy Commissioner of Income-tax [2023] 148 taxmann.com 206

(Madras)

+ % EF ? % 1 !&

#' * =,;-;=$== + ? & 1 ! - ;-;== 1 1

1 % " " & #+' * "

!

( 1 & & . : % . %

1 !& ! #+' *

: & " . ! ! & " !& %

y

y

th

th

og

Ar

Ar

Ar th y og 61

Arthyogog

Illuminating Tax Horizons

Illuminating Tax Horizons

Illuminating Tax Horizons

Illuminating Tax Horizons