Page 68 - Arthyog_FilBook_05 05 2024 (1)

P. 68

! . ! . & #+' * & !

. " . % & .

28. ! .Anurag Gupta vs Income Tax Officer [2023] 454 ITR 326 (Bombay) 8

) " ! & % % .

" . & & #+' * . + . failure of

the assessing officer to provide the requisite material which ought to have been supplied along

with the information ! .

( 1 & & & #+' * .

+ & & . @ " 1 % "

. ! ! . #+' * . + ! 1 % " & "

1 . 1 . 1 & . !

X % D " & 1

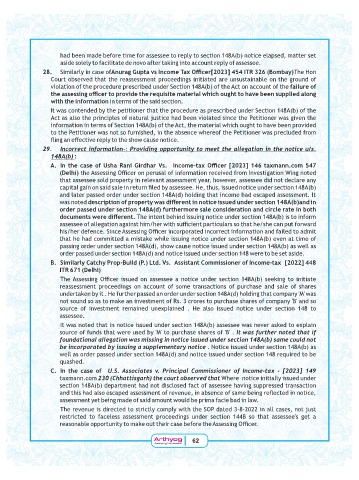

29. Incorrect information-: Providing opportunity to meet the allegation in the notice u/s.

148A(b) :

A. In the case of Usha Rani Girdhar Vs. Income-tax Officer [2023] 146 taxmann.com 547

(Delhi) + % EF & . . ! " . ! ( " % 7 %

& & " ! 1 "

& % ? 8 #+' *

& #+' * % ! & ! (

1 description of property was different in notice issued under section 148A(b)and in

order passed under section 148A(d) furthermore sale consideration and circle rate in both

documents were different. % #+' * . !

. % % !I 1 F & I & . 1

I . + % EF & . ! . !

!! ! 1 % #+' * " ! .

& % #+' * 1 #+' * 1

& #+' * # 1

B. Similarly Catchy Prop-Build (P.) Ltd. Vs. Assistant Commissioner of Income-tax [2022] 448

ITR 671 (Delhi)

+ % EF #+' * %

! & % . ! . & .

8 . & #+' * % !& C C 1

! " ! . - & . !& C C

. " ! ! /& 8 #

( 1 #+' * 1 " /&

. . 1 C C & . C C It was further noted that if

foundational allegation was missing in notice issued under section 148A(b) same could not

be incorporated by issuing a supplementary notice #+' *

1 & #+' * # :

:

C. In the case of U.S. Associates v. Principal Commissioner of Income-tax - [2023] 149

/! ! 230 (Chhattisgarh) the court observed that 7

#+' * & ! . . " % &&

& ! . " . ! % X

! % ! . ! 1 & ! . 1

" !& 1 E -;#;=$== @

. ! & % C %

&& ! . + % EF

y

y

th

th

og

Ar

Ar th y og 62

Arthyogog

Ar

Illuminating Tax Horizons

Illuminating Tax Horizons

Illuminating Tax Horizons

Illuminating Tax Horizons