Page 81 - GTBANK GAMBIA ANNUAL REPORT 2021

P. 81

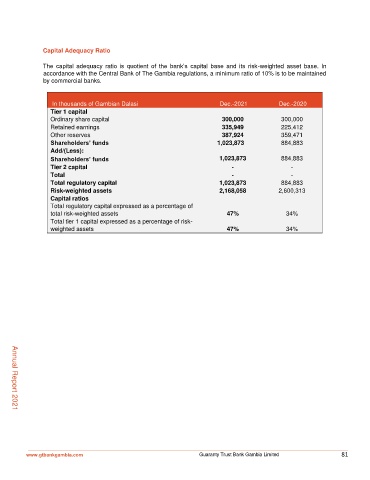

Capital Adequacy Ratio

The capital adequacy ratio is quotient of the bank’s capital base and its risk-weighted asset base. In

accordance with the Central Bank of The Gambia regulations, a minimum ratio of 10% is to be maintained

by commercial banks.

In thousands of Gambian Dalasi Dec.-2021 Dec.-2020

Tier 1 capital

Ordinary share capital 300,000 300,000

Retained earnings 335,949 225,412

Other reserves 387,924 359,471

Shareholders’ funds 1,023,873 884,883

Add/(Less):

Shareholders’ funds 1,023,873 884,883

Tier 2 capital - -

Total - -

Total regulatory capital 1,023,873 884,883

Risk-weighted assets 2,168,058 2,600,313

Capital ratios

Total regulatory capital expressed as a percentage of

total risk-weighted assets 47% 34%

Total tier 1 capital expressed as a percentage of risk-

weighted assets 47% 34%

Annual Report 2021

www.gtbankgambia.com Guaranty Trust Bank Gambia Limited 81