Page 6 - RBS – ABN takeover

P. 6

Name of Bank This organization is known for…..

RBS RBS Motto is make it happen

RBS is known for successful cost cutting after acquisition

Barclays Barclays Motto is quietly conquering the world of finance

Barclays is known for growth by consolidation

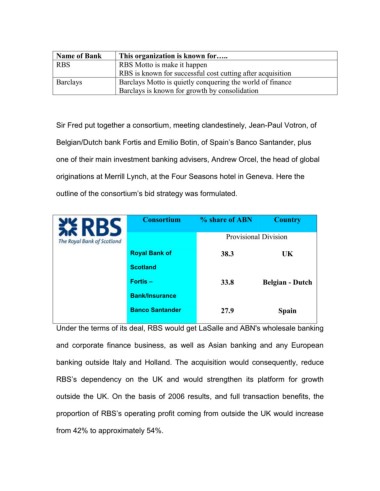

Sir Fred put together a consortium, meeting clandestinely, Jean-Paul Votron, of

Belgian/Dutch bank Fortis and Emilio Botin, of Spain’s Banco Santander, plus

one of their main investment banking advisers, Andrew Orcel, the head of global

originations at Merrill Lynch, at the Four Seasons hotel in Geneva. Here the

outline of the consortium’s bid strategy was formulated.

Consortium % share of ABN Country

Provisional Division

Royal Bank of 38.3 UK

Scotland

Fortis – 33.8 Belgian - Dutch

Bank/Insurance

Banco Santander 27.9 Spain

Under the terms of its deal, RBS would get LaSalle and ABN's wholesale banking

and corporate finance business, as well as Asian banking and any European

banking outside Italy and Holland. The acquisition would consequently, reduce

RBS’s dependency on the UK and would strengthen its platform for growth

outside the UK. On the basis of 2006 results, and full transaction benefits, the

proportion of RBS’s operating profit coming from outside the UK would increase

from 42% to approximately 54%.