Page 149 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 149

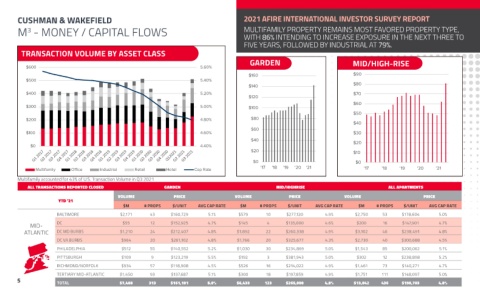

CUSHMAN & WAKEFIELD 2021 AFIRE INTERNATIONAL INVESTOR SURVEY REPORT

M - MONEY / CAPITAL FLOWS MULTIFAMILY PROPERTY REMAINS MOST FAVORED PROPERTY TYPE,

3

WITH 86% INTENDING TO INCREASE EXPOSURE IN THE NEXT THREE TO

FIVE YEARS, FOLLOWED BY INDUSTRIAL AT 79%.

TRANSACTION VOLUME BY ASSET CLASS

GARDEN MID/HIGH-RISE

$600 5.60%

$160 $90

$500 5.40%

$140 $80

$400 5.20% $70

$120

$60

$300 5.00% $100

$50

$200 4.80% $80

$40

$60

$100 4.60% $30

$40 $20

$0 4.40%

$20 $10

$0 $0

Multifamily O

ce Industrial Retail Hotel Cap Rate '17 '18 '19 '20 '21 '17 '18 '19 '20 '21

Multifamily accounted for 43% of U.S. Transaction Volume in Q3 2021

ALL TRANSACTIONS REPORTED CLOSED GARDEN MID/HIGHRISE ALL APARTMENTS

VOLUME PRICE VOLUME PRICE VOLUME PRICE

YTD '21

$M # PROPS $/UNIT AVG CAP RATE $M # PROPS $/UNIT AVG CAP RATE $M # PROPS $/UNIT AVG CAP RATE

BALTIMORE $2,171 43 $160,729 5.1% $579 10 $277,120 4.9% $2,750 53 $178,604 5.0%

MID- DC $55 12 $152,925 4.7% $145 4 $135,000 4.6% $200 16 $147,901 4.7%

ATLANTIC DC MD BURBS $1,210 24 $212,407 4.8% $1,892 22 $260,338 4.9% $3,102 46 $238,491 4.8%

DC VA BURBS $964 20 $261,102 4.8% $1,766 20 $325,677 4.3% $2,730 40 $300,688 4.5%

PHILADELPHIA $512 55 $140,552 5.2% $1,030 30 $234,869 5.0% $1,543 85 $200,062 5.1%

PITTSBURGH $109 9 $123,219 5.5% $192 3 $381,943 5.0% $302 12 $238,898 5.2%

RICHMOND/NORFOLK $934 57 $118,908 4.5% $526 16 $214,022 4.9% $1,461 73 $140,271 4.7%

TERTIARY MID-ATLANTIC $1,450 93 $137,687 5.1% $300 18 $197,859 4.9% $1,751 111 $148,097 5.0%

5 TOTAL $7,408 313 $161,101 5.0% $6,433 123 $265,080 4.8% $13,842 436 $198,703 4.8%