Page 18 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 18

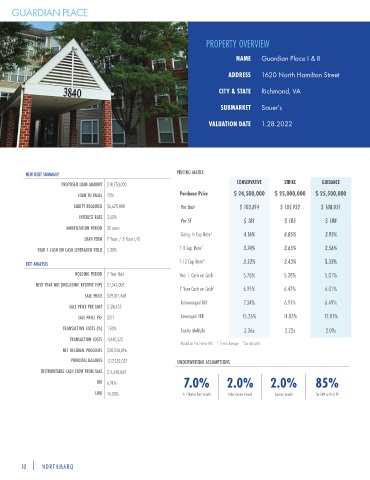

GUARDIAN PLACE

PROPERTY OVERVIEW

NAME Guardian Place I & II

ADDRESS 1620 North Hamilton Street

CITY & STATE Richmond, VA

SUBMARKET Sauer's

VALUATION DATE 1.28.2022

NEW DEBT SUMMARY PRICING MATRX

PROPOSED LOAN AMOUNT $18,750,000 CONSERVATIVE STRIKE GUIDANCE

LOAN TO VALUE 75% Purchase Price $ 24,500,000 $ 25,000,000 $ 25,500,000

EQUITY REQUIRED $6,625,000 Per Unit $ 103,814 $ 105,932 $ 108,051

INTEREST RATE 3.50%

Per SF $ 181 $ 185 $ 188

AMORTIZATION PERIOD 30 years

Going-In Cap Rate 1 4.16% 4.05% 3.95%

LOAN TERM 7 Years / 3 Years I/O

YEAR 1 CASH ON CASH LEVERAGED YIELD 5.38% T-3 Cap Rate* 3.74% 3.65% 3.56%

EXIT ANALYSIS T-12 Cap Rate* 3.52% 3.43% 3.35%

HOLDING PERIOD 7 Year Hold Year 1 Cash on Cash 5.78% 5.38% 5.01%

NEXT YEAR NOI (INCLUDING RESERVE EXP) $1,542,002

7 Year Cash on Cash 6.95% 6.47% 6.01%

2

SALE PRICE $29,371,468

Unleveraged IRR 7.34% 6.91% 6.49%

SALE PRICE PER UNIT $124,455

SALE PRICE PSF $217 Leveraged IRR 15.26% 14.03% 12.81%

TRANSACTION COSTS (%) 1.50% Equity Multiple 2.36x 2.22x 2.09x

TRANSACTION COSTS -$440,572

1 Based on Pro Forma NOI 7-year Average *Tax Adjusted

2

NET RESIDUAL PROCEEDS $28,930,896

PRINCIPAL BALANCE -$17,232,027 UNDERWRITING ASSUMPTIONS

DISTRIBUTABLE CASH FLOW FROM SALE $11,698,869

7.0% 2.0% 2.0% 85%

IRR 6.91%

LIRR 14.03% Yr 1 Market Rent Growth Other Income Growth Expense Growth Tax FMV as % of PP

10 | NORTHMARQ