Page 44 - 2022 Annual Report 2022 01.18 0528

P. 44

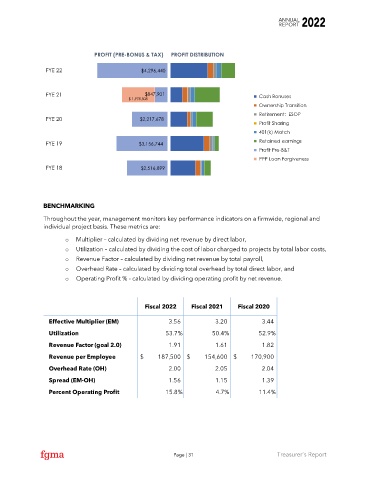

PROFIT (PRE-BONUS & TAX) PROFIT DISTRIBUTION

FYE 22 $4,296,440

FYE 21 $847,901 Cash Bonuses

$ 1,978,508

Ownership Transition

Retirement: ESOP

FYE 20 $2,217,678

Profit Sharing

401(k) Match

FYE 19 $3,156,744 Retained earnings

Profit Pre-B&T

PPP Loan Forgiveness

FYE 18 $2,516,899

BENCHMARKING

Throughout the year, management monitors key performance indicators on a firmwide, regional and

individual project basis. These metrics are:

o Multiplier – calculated by dividing net revenue by direct labor,

o Utilization – calculated by dividing the cost of labor charged to projects by total labor costs,

o Revenue Factor – calculated by dividing net revenue by total payroll,

o Overhead Rate – calculated by dividing total overhead by total direct labor, and

o Operating Profit % - calculated by dividing operating profit by net revenue.

Fiscal 2022 Fiscal 2021 Fiscal 2020

Effective Multiplier (EM) 3.56 3.20 3.44

Utilization 53.7% 50.4% 52.9%

Revenue Factor (goal 2.0) 1.91 1.61 1.82

Revenue per Employee $ 187,500 $ 154,600 $ 170,900

Overhead Rate (OH) 2.00 2.05 2.04

Spread (EM-OH) 1.56 1.15 1.39

Percent Operating Profit 15.8% 4.7% 11.4%

Page | 31 Treasurer’s Report