Page 42 - 2022 Annual Report 2022 FINAL

P. 42

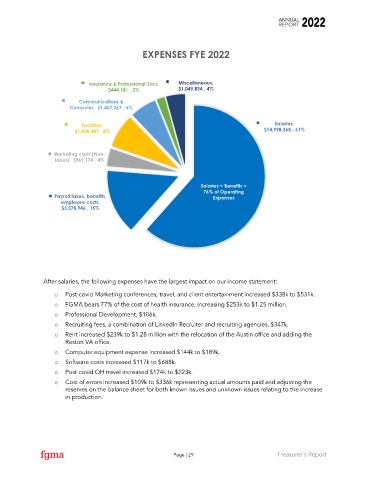

EXPENSES FYE 2022

Insurance & Professional Svcs, Miscellaneous,

$444,181 , 2% $1,049,834 , 4%

Communications &

Computer, $1,467,267 , 6%

Facilities, Salaries,

$1,848,457 , 8% $14,998,368 , 61%

Marketing costs (Non-

labor), $969,174 , 4%

Salaries + Benefits =

76% of Operating

Payroll taxes, benefits, Expenses

employee costs,

$3,578,946 , 15%

After salaries, the following expenses have the largest impact on our income statement:

o Post-covid Marketing conferences, travel, and client entertainment increased $338k to $531k.

o FGMA bears 77% of the cost of health insurance, increasing $253k to $1.25 million.

o Professional Development, $106k.

o Recruiting fees, a combination of LinkedIn Recruiter and recruiting agencies, $347k.

o Rent increased $239k to $1.28 million with the relocation of the Austin office and adding the

Reston VA office.

o Computer equipment expense increased $144k to $189k.

o Software costs increased $117k to $688k.

o Post-covid OH travel increased $174k to $223k.

o Cost of errors increased $109k to $336k representing actual amounts paid and adjusting the

reserves on the balance sheet for both known issues and unknown issues relating to the increase

in production.

Page | 29 Treasurer’s Report