Page 138 - TKZN Annual Report 2023/2024

P. 138

KWAZULU-NATAL TOURISM AUTHORITY

Trading as Tourism KwaZulu-Natal

Annual Financial Statements for the year ended 31 March 2024

Notes to the Annual Financial Statements

24. Change in estimate (continued)

Intangible assets

In terms of GRAP 31, the useful lives of all assets were reviewed. The remaining useful life expectation of certain items of intangible assets differed from previous estimates resulting in a change in accounting estimate. The effect of the revision has decreased the charge by R183 156 (2023:R159 442).The future impact of the change in estimate will result in the same amount being charged as depreciation.

25. Prior period errors

The entity registered for Value Added Tax (VAT) some time ago and claimed input VAT as well as declared Output VAT to the South African Revenue Services (SARS). SARS later raised a query on the entity being a non-trading entity that has no taxable supplies, resulting in more input tax claimed, and limited VAT output paid over to SARS.

In terms of the VAT Act and Interpretation note 39 (Issue 3) issued on 29 March 2017, Tourism KZN as a Schedule 3C public entity is not required to register for VAT. The appropriations made to 3C Public entities is treated outside the scope of the VAT Act as the entities do not make supplies which are in competition with other vendors in the private sector. Supplies by these entities generally involve activities of a regulatory, administrative, stewardship or social nature.

Due to the entity not being eligible to claim input VAT as a Schedule 3C entity that receives an appropriation from EDTEA as the only source of revenue which falls outside the scope of the VAT Act, it was concluded that the VAT debt was raised in error.

The VAT control account accumulated an amount of R4 492 738.94 as an amount due by SARS to the entity. The debt was fully impaired due to the query raised by SARS. The VAT debtor and and the impairment of the debtor have been reversed as prior period adjustments.

The correction of the error results in a NIL effect adjustment as the debtor was fully impaired. The adjustment will be as follows:

• Decrease in Debtors (VAT account debt)

• Decrease in the provision for doubtful debt

Errors include :

• Oversights and misinterpretation of facts

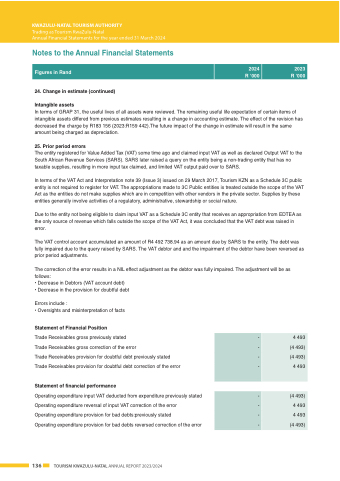

Statement of Financial Position

Trade Receivables gross previously stated

Trade Receivables gross correction of the error

Trade Receivables provision for doubtful debt previously stated Trade Receivables provision for doubtful debt correction of the error

Statement of financial performance

Operating expenditure input VAT deducted from expenditure previously stated Operating expenditure reversal of input VAT correction of the error

Operating expenditure provision for bad debts:previously stated

Operating expenditure provision for bad debts reversed correction of the error

Figures in Rand

2024 R ‘000

2023 R ‘000

-

4 493

-

(4 493)

-

(4 493)

-

4 493

-

(4 493)

-

4 493

-

4 493

-

(4 493)

136 TOURISM KWAZULU-NATAL ANNUAL REPORT 2023/2024