Page 139 - TKZN Annual Report 2023/2024

P. 139

KWAZULU-NATAL TOURISM AUTHORITY

Trading as Tourism KwaZulu-Natal

Annual Financial Statements for the year ended 31 March 2024

Notes to the Annual Financial Statements

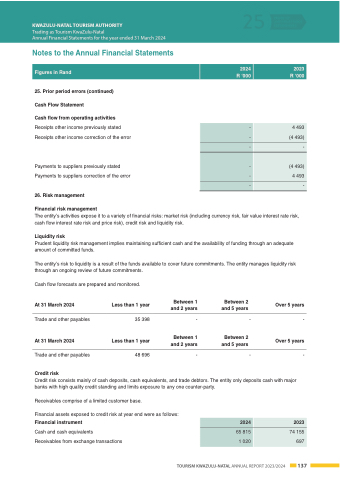

25. Prior period errors (continued)

Cash Flow Statement

Cash flow from operating activities

Receipts other income previously stated Receipts other income correction of the error

Payments to suppliers previously stated Payments to suppliers correction of the error

26. Risk management

Financial risk management

The entity’s activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest rate risk, cash flow interest rate risk and price risk), credit risk and liquidity risk.

Liquidity risk

Prudent liquidity risk management implies maintaining sufficient cash and the availability of funding through an adequate amount of committed funds.

The entity’s risk to liquidity is a result of the funds available to cover future commitments. The entity manages liquidity risk through an ongoing review of future commitments.

Figures in Rand

2024 R ‘000

2023 R ‘000

-

4 493

-

(4 493)

-

-

-

(4 493)

-

4 493

-

-

Cash flow forecasts are prepared and monitored.

At 31 March 2024

Trade and other payables

At 31 March 2024

Trade and other payables

Credit risk

Less than 1 year

48 696

Between 1 and 2 years

-

Between 2 and 5 years

Over 5 years

- -

35 398

Less than 1 year

-

Between 1 and 2 years

-

Between 2 and 5 years

-

Over 5 years

Credit risk consists mainly of cash deposits, cash equivalents, and trade debtors. The entity only deposits cash with major banks with high quality credit standing and limits exposure to any one counter-party.

Receivables comprise of a limited customer base.

Financial assets exposed to credit risk at year end were as follows:

Financial instrument

Cash and cash equivalents

Receivables from exchange transactions

2024

2023

65 815

74 155

1 020

697

TOURISM KWAZULU-NATAL ANNUAL REPORT 2023/2024 137