Page 140 - TKZN Annual Report 2023/2024

P. 140

KWAZULU-NATAL TOURISM AUTHORITY

Trading as Tourism KwaZulu-Natal

Annual Financial Statements for the year ended 31 March 2024

Notes to the Annual Financial Statements

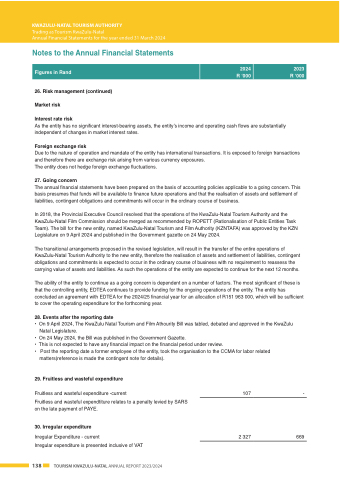

26. Risk management (continued)

Market risk

Interest rate risk

As the entity has no significant interest-bearing assets, the entity’s income and operating cash flows are substantially independent of changes in market interest rates.

Foreign exchange risk

Due to the nature of operation and mandate of the entity has international transactions. It is exposed to foreign transactions and therefore there are exchange risk arising from various currency exposures.

The entity does not hedge foreign exchange fluctuations.

27. Going concern

The annual financial statements have been prepared on the basis of accounting policies applicable to a going concern. This basis presumes that funds will be available to finance future operations and that the realisation of assets and settlement of liabilities, contingent obligations and commitments will occur in the ordinary course of business.

In 2018, the Provincial Executive Council resolved that the operations of the KwaZulu-Natal Tourism Authority and the KwaZulu-Natal Film Commission should be merged as recommended by ROPETT (Rationalisation of Public Entities Task Team). The bill for the new entity, named KwaZulu-Natal Tourism and Film Authority (KZNTAFA) was approved by the KZN Legislature on 9 April 2024 and published in the Government gazette on 24 May 2024.

The transitional arrangements proposed in the revised legislation, will result in the transfer of the entire operations of KwaZulu-Natal Tourism Authority to the new entity, therefore the realisation of assets and settlement of liabilities, contingent obligations and commitments is expected to occur in the ordinary course of business with no requirement to reassess the carrying value of assets and liabilities. As such the operations of the entity are expected to continue for the next 12 months.

The ability of the entity to continue as a going concern is dependent on a number of factors. The most significant of these is that the controlling entity, EDTEA continues to provide funding for the ongoing operations of the entity. The entity has concluded an agreement with EDTEA for the 2024/25 financial year for an allocation of R151 963 000, which will be sufficient to cover the operating expenditure for the forthcoming year.

28. Events after the reporting date

• On 9 April 2024, The KwaZulu Natal Tourism and Film Athourity Bill was tabled, debated and approved in the KwaZulu Natal Legislature.

• On 24 May 2024, the Bill was published in the Government Gazette.

• This is not expected to have any financial impact on the financial period under review.

• Post the reporting date a former employee of the entity, took the organisation to the CCMA for labor related

Figures in Rand

2024 R ‘000

2023 R ‘000

matters(reference is made the contingent note for details).

29. Fruitless and wasteful expenditure

Fruitless and wasteful expenditure -current

Fruitless and wasteful expendtiture relates to a penalty levied by SARS on the late payment of PAYE.

30. Irregular expenditure

Irregular Expenditure - current

Irregular expenditure is presented inclusive of VAT

107 -

2 327 669

138 TOURISM KWAZULU-NATAL ANNUAL REPORT 2023/2024