Page 75 - Playhouse Annual Report 2021:22

P. 75

Notes to the Annual Financial Statements (continued)

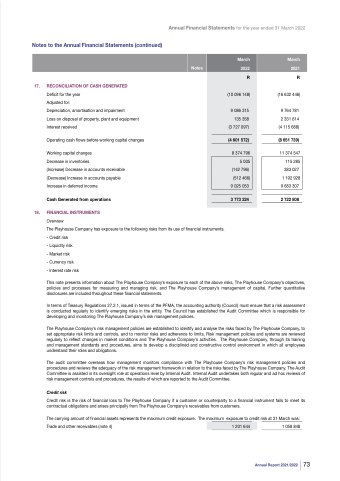

17. RECONCILIATION OF CASH GENERATED

Deficit for the year

Adjusted for:

Depreciation, amortisation and impairment

Loss on disposal of property, plant and equipment Interest received

Operating cash flows before working capital changes

Working capital changes

Decrease in inventories

(Increase) Decrease in accounts receivable (Decrease) Increase in accounts payable Increase in deferred income

Cash Generated from operations

18. FINANCIAL INSTRUMENTS

Overview

The Playhouse Company has exposure to the following risks from its use of financial instruments. - Credit risk

- Liquidity risk

- Market risk

- Currency risk

- Interest rate risk

R

(16 632 446)

9 764 781

2 331 614 (4 115 688)

(8 651 739)

11 374 547

2 722 808

Annual Financial Statements for the year ended 31 March 2022

Notes

March

(10 096 148)

9 086 315

2022

135 358

(3 727 097)

(4 601 572)

8 374 796

R

March

2021

5 005

(142 796)

(512 466)

9 025 053

3 773 224

115 285 383 027 1 192 928 9 683 307

This note presents information about The Playhouse Company’s exposure to each of the above risks, The Playhouse Company’s objectives, policies and processes for measuring and managing risk, and The Playhouse Company’s management of capital. Further quantitative disclosures are included throughout these financial statements.

In terms of Treasury Regulations 27.2.1, issued in terms of the PFMA, the accounting authority (Council) must ensure that a risk assessment is conducted regularly to identify emerging risks in the entity. The Council has established the Audit Committee which is responsible for developing and monitoring The Playhouse Company’s risk management policies.

The Playhouse Company’s risk management policies are established to identify and analyse the risks faced by The Playhouse Company, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changes in market conditions and The Playhouse Company’s activities. The Playhouse Company, through its training and management standards and procedures, aims to develop a disciplined and constructive control environment in which all employees understand their roles and obligations.

The audit committee overseas how management monitors compliance with The Playhouse Company’s risk management policies and procedures and reviews the adequacy of the risk management framework in relation to the risks faced by The Playhouse Company. The Audit Committee is assisted in its oversight role at operations level by Internal Audit. Internal Audit undertakes both regular and ad hoc reviews of risk management controls and procedures, the results of which are reported to the Audit Committee.

Credit risk

Credit risk is the risk of financial loss to The Playhouse Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises principally from The Playhouse Company’s receivables from customers.

The carrying amount of financial assets represents the maximum credit exposure. The maximum exposure to credit risk at 31 March was: Trade and other receivables (note 4) 1 058 848

1 201 644

Annual Report 2021/2022 73