Page 76 - Playhouse Annual Report 2021:22

P. 76

Annual Financial Statements for the year ended 31 March 2022 Notes to the Annual Financial Statements (continued)

18. FINANCIAL INSTRUMENTS (CONTINUED)

Trade and other receivables

R

The Playhouse Company’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. The composition of The Playhouse Company’s customer base, including the default risk of the industry and country in which the customers operate, has less of an influence on credit risk.

The majority of other receivables and accruals relates to interest income receivable from financial institutions for monies invested in fixed deposits.

The trade debtors comprise monies outstanding for the services as follows:

Truck hire - deposits or order numbers are received before the truck is hired out for cultural events. Rental - Deposits are held from tenants.

Function venue hire - Deposits are received in advance.

Costume/props/wigs hire - fees are received before items are hired out.

Ticket sales - monies are received from sales at the door or through Webticket.

The Playhouse Company policy is to monitor its exposure to credit risk on a monthly basis. At year end, the maximum exposure to credit risk is represented by the carrying amount of each financial asset.

The calculation for the fair valuing of trade and other receivables is performed, however, the adjustment is not processed as the adjustment amount is not material.

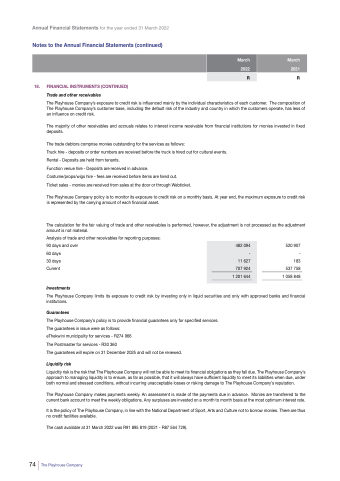

Analysis of trade and other receivables for reporting purposes: 90 days and over

60 days

30 days

Current

Investments

520 907 - 183 537 758 1 058 848

482 094

-

11 627

707 924

1 201 644

1 882 178

The Playhouse Company limits its exposure to credit risk by investing only in liquid securities and only with approved banks and financial institutions.

Guarantees

The Playhouse Company’s policy is to provide financial guarantees only for specified services. The guarantees in issue were as follows:

eThekwini municipality for services - R274 966

The Postmaster for services - R30 360

The guarantees will expire on 31 December 2025 and will not be renewed.

Liquidity risk

Liquidity risk is the risk that The Playhouse Company will not be able to meet its financial obligations as they fall due. The Playhouse Company’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to The Playhouse Company’s reputation.

The Playhouse Company makes payments weekly. An assessment is made of the payments due in advance. Monies are transferred to the current bank account to meet the weekly obligations. Any surpluses are invested on a month to month basis at the most optimum interest rate.

It is the policy of The Playhouse Company, in line with the National Department of Sport, Arts and Culture not to borrow monies. There are thus no credit facilities available.

The cash available at 31 March 2022 was R91 895 819 (2021 - R87 564 729).

74 The Playhouse Company

March

2022

1 366 265

March

2021

R