Page 77 - Playhouse Annual Report 2021:22

P. 77

Notes to the Annual Financial Statements (continued)

18. FINANCIAL INSTRUMENTS (CONTINUED)

Market risk

Annual Financial Statements for the year ended 31 March 2022

March

2022

Market risk is the risk that changes in market prices, such as the interest rates will affect The Playhouse Company’s income. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while optimizing return.

The Playhouse Company policy, in line with the National Department of Sport, Arts and Culture is to invest surplus cash. Optimal rates and investment periods are received from various banking institutions. A proposal is made and approved by senior management.

Currency risk

Currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Playhouse Company is exposed to foreign exchange risk through its import of capital equipment. The currency in which these transactions are primarily denominated is EUR. The Playhouse Company’s risk management policy is not to take out forward exchange contracts.

Interest rate risk

It is the policy of The Playhouse Company, in line with the National Department of Sport, Arts and Culture not to borrow monies. There are thus no credit facilities available. There is thus no risk relating to changes in the interest rate.

The Playhouse Company policy, in line with the National Department of Sport, Arts and Culture is to invest surplus cash. Optimal rates and periods are received from various institutions. A proposal is made and approved by senior management.

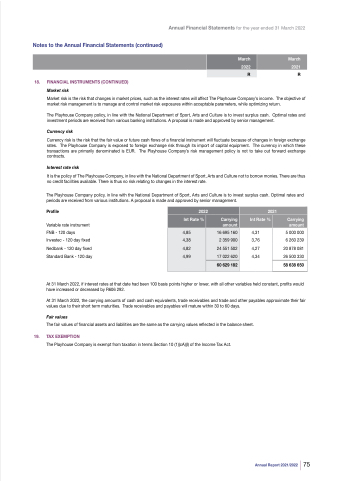

Profile

Variable rate instrument FNB - 120 days

Investec - 120 day fixed Nedbank - 120 day fixed Standard Bank - 120 day

At 31 March 2022, if interest rates at that date had been 100 basis points higher or lower, with all other variables held constant, profits would have increased or decreased by R606 292.

At 31 March 2022, the carrying amounts of cash and cash equivalents, trade receivables and trade and other payables approximate their fair values due to their short term maturities. Trade receivables and payables will mature within 30 to 60 days.

Fair values

The fair values of financial assets and liabilities are the same as the carrying values reflected in the balance sheet.

19. TAX EXEMPTION

The Playhouse Company is exempt from taxation in terms Section 10 (1)(cA)(I) of the Income Tax Act.

Annual Report 2021/2022 75

March

2021

R

R

2022

2021

Int Rate %

Carrying amount

Int Rate %

Carrying amount

4,85

16 695 160

4,31 3,76 4,27 4,34

5 000 000

6 260 239 20 878 081 26 500 330

4,38

2 359 900

4,82

24 551 502

4,99

17 022 620

60 629 182

58 638 650