Page 9 - Prestige

P. 9

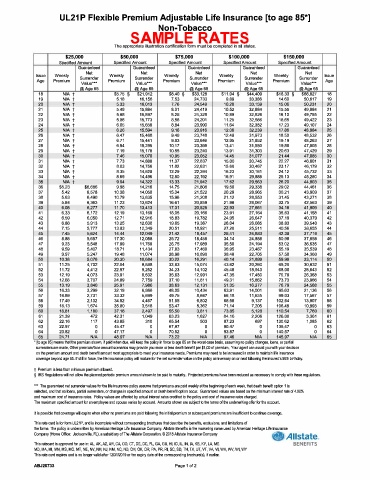

UL21 P Flexible Premium Adjustable Life Insurance [to age 85*]

Non-Tobacco

SAMPLE RATES

The appropriate illustration certification form must be completed in all states.

$25,000 $50,000 $75,000 $100,000 $150,000

Soecified Amount Soecified Amount Soecified Amount Soecified Amount Soecified Amount

Guaranteed Guaranteed Guaranteed Guaranteed Guaranteed

Net Net Net Net Net

Issue Weekly Surrender Weekly Surrender Weekly Surrender Weekly Surrender Weekly Surrender Issue

Age Premium Premium Premium Premium Premium Age

Value*** Value*** Value*** Value*** Value***

@Aoe 65 @Aoe 65 @Aoe 65 @Aoe 65 @Aoe 65

18 N/A t $5.75 § $21,912 $8.40 § $33,128 $11.04 § $44,409 $16.33 § $66,827 18

19 N/A t 5.18 16,156 7.53 24,733 9.89 33,386 14.60 50,617 19

20 N/A t 5.33 16,013 7.76 24,549 10.20 33,159 15.06 50,231 20

21 N/A t 5.49 15,884 8.01 24,419 10.52 32,884 15.55 49,884 21

22 N/A t 5.68 15,897 8.28 24,328 10.89 32,826 16.10 49,755 22

23 N/A t 5.86 15,773 8.56 24,201 11.25 32,566 16.65 49,422 23

24 N/A t 6.05 15,658 8.84 23,990 11.64 32,382 17.23 49,107 24

25 N/A t 6.26 15,594 9.16 23,916 12.06 32,239 17.86 48,884 25

26 N/A t 6.47 15,468 9.48 23,748 12.48 31,973 18.50 48,532 26

27 N/A t 6.71 15,441 9.83 23,646 12.95 31,852 19.19 48,263 27

28 N/A t 6.94 15,295 10.17 23,398 13.41 31,550 19.88 47,805 28

29 N/A t 7.19 15,178 10.55 23,240 13.91 31,303 20.63 47,429 29

30 N/A t 7.46 15,070 10.95 23,052 14.45 31,077 21.44 47,085 30

31 N/A t 7.73 14,888 11.37 22,837 15.00 30,745 22.27 46,601 31

32 N/A t 8.03 14,756 11.82 22,631 15.60 30,467 23.17 46,179 32

33 N/A t 8.35 14,628 12.29 22,394 16.23 30,161 24.12 45,732 33

34 N/A t 8.69 14,496 12.80 22,192 16.91 29,888 25.13 45,280 34

35 N/A t 9.04 14,322 13.33 21,942 17.62 29,563 26.20 44,803 35

36 $5.23 $6,686 9.98 14,216 14.75 21,808 19.50 29,338 29.02 44,461 36

37 5.42 6,578 10.38 14,050 15.34 21,522 20.29 28,965 30.21 43,909 37

38 5.63 6,490 10.79 13,835 15.96 21,208 21.12 28,553 31.45 43,271 38

39 5.84 6,363 11.23 13,624 16.61 20,859 21.98 28,067 32.75 42,563 39

40 6.08 6,277 11.70 13,413 17.31 20,525 22.93 27,661 34.16 41,909 40

41 6.33 6,172 12.19 13,169 18.05 20,166 23.91 27,164 35.63 41,158 41

42 6.59 6,050 12.71 12,916 18.83 19,782 24.95 26,647 37.19 40,379 42

43 6.86 5,913 13.25 12,630 19.65 19,367 26.04 26,085 38.83 39,540 43

44 7.15 5,777 13.83 12,349 20.51 18,921 27.20 25,511 40.56 38,655 44

45 7.45 5,624 14.44 12,049 21.42 18,457 28.41 24,883 42.38 37,716 45

46 8.88 5,657 17.30 12,058 25.72 18,458 34.14 24,858 50.98 37,658 46

47 9.23 5,548 17.99 11,769 26.75 17,989 35.50 24,194 53.02 36,635 47

48 9.59 5,407 18.71 11,434 27.83 17,460 36.95 23,487 55.19 35,539 48

49 9.97 5,247 19.48 11,074 28.98 16,890 38.48 22,705 57.50 34,360 49

50 10.38 5,076 20.30 10,684 30.22 16,291 40.14 21,899 59.98 33,114 50

51 11.25 4,702 22.04 9,888 32.83 15,074 43.62 20,260 65.20 30,632 51

52 11.72 4,412 22.97 9,252 34.23 14,102 45.48 18,943 68.00 28,643 52

53 12.19 4,073 23.91 8,532 35.63 12,991 47.35 17,450 70.79 26,368 53

54 12.68 3,707 24.89 7,759 37.10 11,811 49.31 15,862 73.73 23,966 54

55 13.19 3,840 25.91 7,986 38.63 12,131 51.35 16,277 76.79 24,568 55

56 16.33 3,299 32.19 6,866 48.05 10,434 63.91 14,001 95.63 21,136 56

57 16.89 2,731 33.32 5,699 49.75 8,667 66.18 11,635 99.03 17,567 57

58 17.49 2,132 34.52 4,467 51.55 6,802 68.58 9,137 102.64 13,807 58

59 18.13 1,674 35.80 3,518 53.47 5,362 71.14 7,205 106.48 10,893 59

60 18.81 1,180 37.16 2,497 55.50 3,811 73.85 5,128 110.54 7,760 60

61 21.39 472 42.31 1,049 63.23 1,627 84.16 2,206 126.00 3,361 61

62 22.16 117 43.85 310 65.54 503 87.23 697 130.62 1,085 62

63 22.97 0 45.47 0 67.97 0 90.47 0 135.47 0 63

64 23.82 0 47.17 0 70.52 0 93.87 0 140.57 0 64

65 24.71 N/A 48.97 N/A 73.22 N/A 97.46 N/A 145.97 N/A 65

• [to age 85] means that the premium shown, if paid when due, will keep the policy in force to age 85 on the worst-case basis, assuming no policy changes, loans, or partial

surrenders are made. Other premium/face amount scenarios may provide you more or less death benefit per $1.00 of premium. Your agent can assist you with your decision

on the premium amount and death benefit amount most appropriate to meet your insurance needs. Premiums may need to be increased in order to maintain life insurance

coverage beyond age 85. If still in force, the life insurance policy will mature for the net surrender value on the policy anniversary on or next fdlowing the insured's 95th birthday.

t Premium is less than minimum premium allowed.

§ IRS Regulations will not allow the planned periodic premium amount shown to be paid to maturity. Projected premiums have been reduced as necessary to comply with these regulations.

"' The guaranteed net surrender values for the life insurance policy assume that premiums are paid weekly at the beginning of each week, that death benefit option 1 is

selected, and that no loans, partial surrenders, or changes in specified amount or death benefit option occur. Guaranteed values are based on the minimum interest rate of 4.00%

and maximum cost of insurance rates. Policy values are affected by actual interest rates credited to the policy and cost of insurance rates charged.

The maximum specified amount for an employee and spouse varies by account Amounts shown are subject to the terms of the underwriting offer for the account

It is possible that coverage will expire when either no premiums are paid following the initial premium or subsequent premiums are insufficient to continue coverage.

This rate card is for form UL21 P, and is incomplete without corresponding brochures that describe the benefits, exdusions, and limitations of

the forms. The policy is underwritten by American Heritage Life Insurance Company. Allstate Benefits is the marketing name used by American Heritage Life Insurance

Company (Home Office: Jacksonville, FL), a subsidiary of The Allstate Corporation.© 2018 Allstate Insurance Company

- A II state 0

This ratecard is approved for use in: AL, AK, AZ, AR, CA, CO, CT, DE, DC, FL, GA, GU, HI, ID, IL, IN, IA, KS, KY, LA, ME BENEFITS

����-������*����������m��������m

This rate card expires and is no longer valid after 12/31/2019 or the expiry date of the corresponding brochure(s), if earlier.

ABJ20733 Page 1 of 2