Page 12 - AZ Home Guide

P. 12

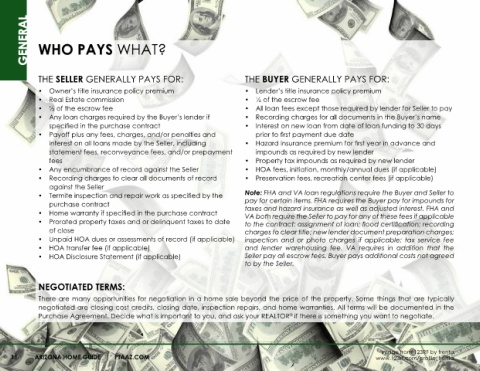

GENERAL WHO PAYS WHAT?

THE SELLER GENERALLY PAYS FOR: THE BUYER GENERALLY PAYS FOR:

• Owner’s title insurance policy premium • Lender’s title insurance policy premium

• Real Estate commission • ½ of the escrow fee

• ½ of the escrow fee • All loan fees except those required by lender for Seller to pay

• Any loan charges required by the Buyer’s lender if • Recording charges for all documents in the Buyer’s name

specified in the purchase contract • Interest on new loan from date of loan funding to 30 days

• Payoff plus any fees, charges, and/or penalties and prior to first payment due date

interest on all loans made by the Seller, including • Hazard insurance premium for first year in advance and

statement fees, reconveyance fees, and/or prepayment impounds as required by new lender

fees • Property tax impounds as required by new lender

• Any encumbrance of record against the Seller • HOA fees, initiation, monthly/annual dues (if applicable)

• Recording charges to clear all documents of record • Preservation fees, recreation center fees (if applicable)

against the Seller

• Termite inspection and repair work as specified by the Note: FHA and VA loan regulations require the Buyer and Seller to

purchase contract pay for certain items. FHA requires the Buyer pay for impounds for

taxes and hazard insurance as well as adjusted interest. FHA and

• Home warranty if specified in the purchase contract VA both require the Seller to pay for any of these fees if applicable

• Prorated property taxes and or delinquent taxes to date to the contract: assignment of loan; flood certification; recording

of close charges to clear title; new lender document preparation charges;

• Unpaid HOA dues or assessments of record (if applicable) inspection and or photo charges if applicable; tax service fee

• HOA transfer fee (if applicable) and lender warehousing fee. VA requires in addition that the

• HOA Disclosure Statement (if applicable) Seller pay all escrow fees. Buyer pays additional costs not agreed

to by the Seller.

NEGOTIATED TERMS:

There are many opportunities for negotiation in a home sale beyond the price of the property. Some things that are typically

negotiated are closing cost credits, closing date, inspection repairs, and home warranties. All terms will be documented in the

Purchase Agreement. Decide what is important to you, and ask your REALTOR if there is something you want to negotiate.

®

Image from 123RF by frenta

11 ARIZONA HOME GUIDE | PTAAZ.COM www.123rf.com/profile_frenta