Page 227 - 2024 Orientation Manual

P. 227

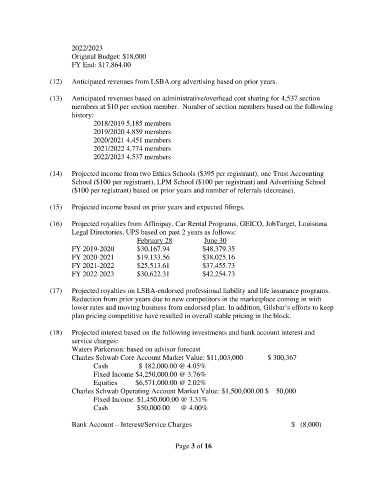

2022/2023

Original Budget: $18,000

FY End: $17,864.00

(12) Anticipated revenues from LSBA.org advertising based on prior years.

(13) Anticipated revenues based on administrative/overhead cost sharing for 4,537 section

members at $10 per section member. Number of section members based on the following

history:

2018/2019 5,185 members

2019/2020 4,859 members

2020/2021 4,451 members

2021/2022 4,774 members

2022/2023 4,537 members

(14) Projected income from two Ethics Schools ($395 per registrant), one Trust Accounting

School ($100 per registrant), LPM School ($100 per registrant) and Advertising School

($100 per registrant) based on prior years and number of referrals (decrease).

(15) Projected income based on prior years and expected filings.

(16) Projected royalties from Affinipay, Car Rental Programs, GEICO, JobTarget, Louisiana

Legal Directories, UPS based on past 2 years as follows:

February 28 June 30

FY 2019-2020 $30,167.94 $48,379.35

FY 2020-2021 $19,133.56 $38,025.16

FY 2021-2022 $25,513.61 $37,455.73

FY 2022-2023 $30,622.31 $42,254.73

(17) Projected royalties on LSBA-endorsed professional liability and life insurance programs.

Reduction from prior years due to new competitors in the marketplace coming in with

lower rates and moving business from endorsed plan. In addition, Gilsbar’s efforts to keep

plan pricing competitive have resulted in overall stable pricing in the block.

(18) Projected interest based on the following investments and bank account interest and

service charges:

Waters Parkerson: based on advisor forecast

Charles Schwab Core Account Market Value: $11,003,000 $ 300,367

Cash $ 182,000.00 @ 4.05%

Fixed Income $4,250,000.00 @ 3.76%

Equities $6,571,000.00 @ 2.02%

Charles Schwab Operating Account Market Value: $1,500,000.00 $ 50,000

Fixed Income $1,450,000.00 @ 3.31%

Cash $50,000.00 @ 4.00%

Bank Account – Interest/Service Charges $ (8,000)

Page 3 of 16