Page 42 - 2018 Annual Report

P. 42

Table of Contents

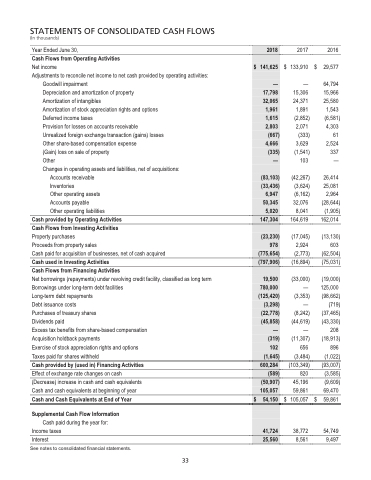

STATEMENTS OF CONSOLIDATED CASH FLOWS

(In thousands)

Year Ended June 30,

Cash Flows from Operating Activities

Net income

Adjustments to reconcile net income to net cash provided by operating activities:

Goodwill impairment

Depreciation and amortization of property

Amortization of intangibles

Amortization of stock appreciation rights and options

Deferred income taxes

Provision for losses on accounts receivable

Unrealized foreign exchange transaction (gains) losses

Other share-based compensation expense

(Gain) loss on sale of property

Other

Changes in operating assets and liabilities, net of acquisitions:

$

2017 133,910

— 15,306 24,371 1,891

(2,852) 2,071

(333) 3,629

(1,541) 103

2016

29,577

64,794 15,966 25,580

1,543 (6,581) 4,303

61 2,524 337 —

26,414 25,081 2,964

(28,644) (1,905)

162,014

(13,130) 603

(62,504) (75,031)

(19,000) 125,000

(98,662) (719) (37,465) (43,330)

208 (18,913)

896 (1,022) (93,007) (3,585) (9,609)

69,470 $ 59,861

54,749 9,497

2018

$ 141,625

— 17,798 32,065 1,961 1,615 2,803

(667) 4,666

(335) —

(83,103) (33,436)

6,947 50,345 5,020

147,304

(23,230) 978

(775,654)

(797,906)

19,500 780,000

(125,420) (3,298) (22,778) (45,858)

— (319)

102 (1,645)

600,284

(589)

(50,907) 105,057

$ 54,150

41,724

25,560

Accounts receivable

Inventories (3,624)

Other operating assets Accounts payable

Other operating liabilities

Cash provided by Operating Activities Cash Flows from Investing Activities Property purchases

Proceeds from property sales

Cash paid for acquisition of businesses, net of cash acquired

Cash used in Investing Activities

Cash Flows from Financing Activities

Net borrowings (repayments) under revolving credit facility, classified as long term

Borrowings under long-term debt facilities

Long-term debt repayments

Debt issuance costs

Purchases of treasury shares

Dividends paid

Excess tax benefits from share-based compensation

Acquisition holdback payments

Exercise of stock appreciation rights and options

Taxes paid for shares withheld

Cash provided by (used in) Financing Activities

Effect of exchange rate changes on cash

(Decrease) increase in cash and cash equivalents

Cash and cash equivalents at beginning of year

Cash and Cash Equivalents at End of Year $

Supplemental Cash Flow Information

Cash paid during the year for: Income taxes

(6,162) 32,076 8,041 164,619

(17,045) 2,924

(2,773) (16,894)

(33,000) —

(3,353) —

(8,242) (44,619)

— (11,307)

656 (3,484) (103,349)

820 45,196 59,861 105,057

(42,267)

$

38,772 Interest 8,561

See notes to consolidated financial statements.

33

33