Page 13 - Legacy Brochure

P. 13

Gifts to the Malvernian Society are exempt from UK Inheritance Tax (IHT) and Capital Gains Tax. The value of a legacy gift is deducted from the total value of your estate before Inheritance Tax is calculated.

Married couples are allowed to pass their possessions and assets to each other tax-free.

If your estate passes to non-exempt beneficiaries (such as your children), IHT is due at 40% on the balance of your estate above your tax-free allowance. This allowance, also known

as the nil-rate band, is currently £325,000 but you may be

entitled to additional tax allowances if you have previously been widowed or leave a residential property to direct descendants. However, it is possible to reduce the rate of IHT to 36% if at least 10% of your net estate is left to charity.

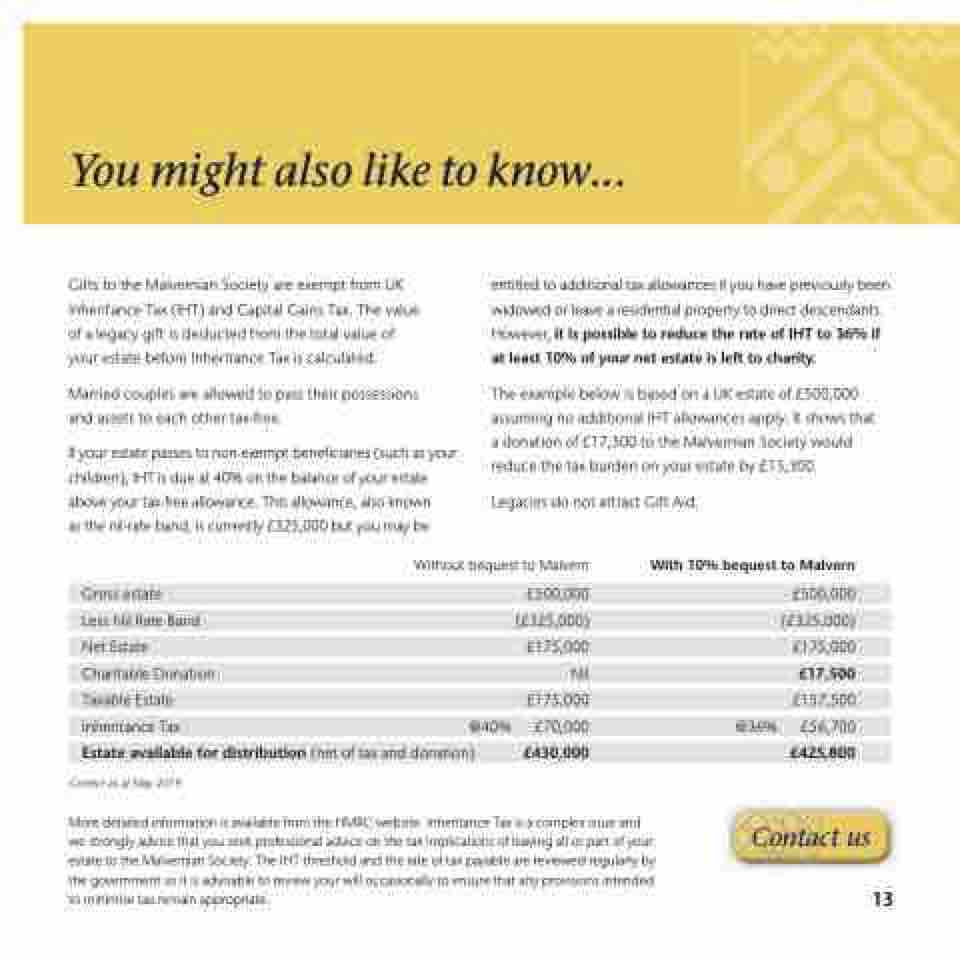

The example below is based on a UK estate of £500,000 assuming no additional IHT allowances apply. It shows that a donation of £17,500 to the Malvernian Society would reduce the tax burden on your estate by £13,300.

Legacies do not attract Gift Aid.

Without bequest to Malvern £500,000

With 10% bequest to Malvern

Gross estate

Less Nil Rate Band

Net Estate

Charitable Donation

Taxable Estate

Inheritance Tax

Estate available for distribution (net of tax and donation)

Correct as at May 2019.

(£325,000) £175,000 Nil £175,000 £70,000 £430,000

£500,000 (£325,000) £175,000 £17,500 £157,500 £56,700 £425,800

@40%

@36%

More detailed information is available from the HMRC website. Inheritance Tax is a complex issue and we strongly advise that you seek professional advice on the tax implications of leaving all or part of your estate to the Malvernian Society. The IHT threshold and the rate of tax payable are reviewed regularly by the government so it is advisable to review your will occasionally to ensure that any provisions intended to minimise tax remain appropriate.

Contact us

13

You might also like to know...