Page 34 - Financial Statement Analysis

P. 34

sub79433_ch01.qxd 4/7/08 11:20 AM Page 11

Chapter One | Overview of Financial Statement Analysis 11

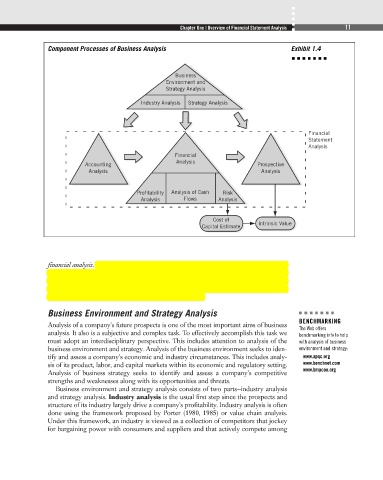

Component Processes of Business Analysis Exhibit 1.4

Business

Environment and

Strategy Analysis

Industry Analysis Strategy Analysis

Financial

Statement

Analysis

Financial

Analysis

Accounting Prospective

Analysis Analysis

Profitability Analysis of Cash Risk

Analysis Flows Analysis

Cost of

Capital Estimate Intrinsic Value

financial analysis. In turn, the quality of financial analysis depends on the reliability and

economic content of the financial statements. This requires accounting analysis of finan-

cial statements. Financial statement analysis involves all of these component processes—

accounting, financial, and prospective analyses. This section discusses each of these

component processes in the context of business analysis.

Business Environment and Strategy Analysis

BENCHMARKING

Analysis of a company’s future prospects is one of the most important aims of business The Web offers

analysis. It also is a subjective and complex task. To effectively accomplish this task we benchmarking info to help

must adopt an interdisciplinary perspective. This includes attention to analysis of the with analysis of business

business environment and strategy. Analysis of the business environment seeks to iden- environment and strategy:

tify and assess a company’s economic and industry circumstances. This includes analy- www.apqc.org

sis of its product, labor, and capital markets within its economic and regulatory setting. www.benchnet.com

Analysis of business strategy seeks to identify and assess a company’s competitive www.bmpcoe.org

strengths and weaknesses along with its opportunities and threats.

Business environment and strategy analysis consists of two parts—industry analysis

and strategy analysis. Industry analysis is the usual first step since the prospects and

structure of its industry largely drive a company’s profitability. Industry analysis is often

done using the framework proposed by Porter (1980, 1985) or value chain analysis.

Under this framework, an industry is viewed as a collection of competitors that jockey

for bargaining power with consumers and suppliers and that actively compete among