Page 29 - Financial Statement Analysis

P. 29

sub79433_ch01.qxd 4/7/08 11:20 AM Page 6

6 Financial Statement Analysis

Colgate’s brand leadership together with its international diversification and sensible

business strategies have enabled it to become one of the most successful consumer

products’ companies in the world. In 2006, Colgate earned $1.35 billion on sales rev-

enues of more than $12 billion. Its operating profit margin was in excess of 10% of sales,

which translates to a return on assets of above 15%, suggesting that Colgate is fairly

profitable. Colgate’s small equity base, however, leverages its return on equity in 2006

to a spectacular 98%, one of the highest of all publicly traded companies. The stock

market has richly rewarded Colgate’s excellent financial performance and low risk: the

company’s price-to-earnings and its price-to-book ratios are, respectively, 26 and 23,

and its stock price has doubled during the past 10 years.

In our previous discussion, we reference a number of financial performance mea-

sures, such as operating profit margins, return on assets, and return on equity. We also

refer to certain valuation ratios such as price-to-earnings and price-to-book, which

appear to measure how the stock market rewards Colgate’s performance. Financial

statements provide a rich and reliable source of information for such financial analysis.

The statements reveal how a company obtains its resources (financing), where and

how those resources are deployed (investing), and how effectively those resources are

deployed (operating profitability). Many individuals and organizations use financial

statements to improve business decisions. Investors and creditors use them to assess

company prospects for investing and lending decisions. Boards of directors, as investor

representatives, use them to monitor managers’ decisions and actions. Employees and

unions use financial statements in labor negotiations. Suppliers use financial statements

in setting credit terms. Investment advisors and information intermediaries use financial

statements in making buy-sell recommendations and in credit rating. Investment

bankers use financial statements in determining company value in an IPO, merger, or

acquisition.

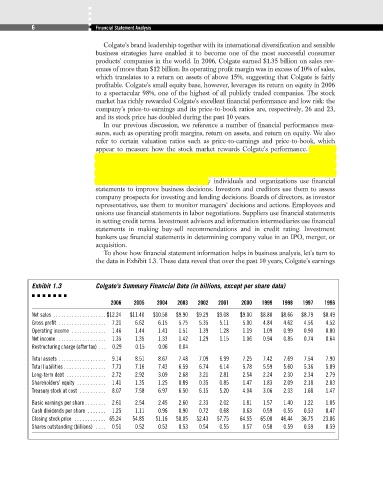

To show how financial statement information helps in business analysis, let’s turn to

the data in Exhibit 1.3. These data reveal that over the past 10 years, Colgate’s earnings

Exhibit 1.3 Colgate’s Summary Financial Data (in billions, except per share data)

2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996

Net sales . . . . . . . . . . . . . . . . . . . . $12.24 $11.40 $10.58 $9.90 $9.29 $9.08 $9.00 $8.80 $8.66 $8.79 $8.49

Gross profit . . . . . . . . . . . . . . . . . . 7.21 6.62 6.15 5.75 5.35 5.11 5.00 4.84 4.62 4.56 4.52

Operating income . . . . . . . . . . . . . 1.46 1.44 1.41 1.51 1.39 1.28 1.19 1.09 0.99 0.90 0.80

Net income . . . . . . . . . . . . . . . . . . 1.35 1.35 1.33 1.42 1.29 1.15 1.06 0.94 0.85 0.74 0.64

Restructuring charge (after tax) . . . 0.29 0.15 0.06 0.04

Total assets . . . . . . . . . . . . . . . . . . 9.14 8.51 8.67 7.48 7.09 6.99 7.25 7.42 7.69 7.54 7.90

Total liabilities . . . . . . . . . . . . . . . . 7.73 7.16 7.43 6.59 6.74 6.14 5.78 5.59 5.60 5.36 5.89

Long-term debt . . . . . . . . . . . . . . . 2.72 2.92 3.09 2.68 3.21 2.81 2.54 2.24 2.30 2.34 2.79

Shareholders’ equity . . . . . . . . . . . 1.41 1.35 1.25 0.89 0.35 0.85 1.47 1.83 2.09 2.18 2.03

Treasury stock at cost . . . . . . . . . . 8.07 7.58 6.97 6.50 6.15 5.20 4.04 3.06 2.33 1.68 1.47

Basic earnings per share . . . . . . . . 2.61 2.54 2.45 2.60 2.33 2.02 1.81 1.57 1.40 1.22 1.05

Cash dividends per share . . . . . . . 1.25 1.11 0.96 0.90 0.72 0.68 0.63 0.59 0.55 0.53 0.47

Closing stock price . . . . . . . . . . . . 65.24 54.85 51.16 50.05 52.43 57.75 64.55 65.00 46.44 36.75 23.06

Shares outstanding (billions) . . . . 0.51 0.52 0.53 0.53 0.54 0.55 0.57 0.58 0.59 0.59 0.59