Page 48 - Financial Statement Analysis

P. 48

sub79433_ch01.qxd 4/7/08 11:20 AM Page 25

Chapter One | Overview of Financial Statement Analysis 25

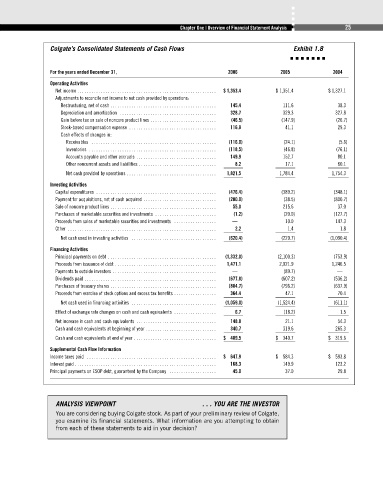

Colgate’s Consolidated Statements of Cash Flows Exhibit 1.8

For the years ended December 31, 2006 2005 2004

Operating Activities

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,353.4 $ 1,351.4 $ 1,327.1

Adjustments to reconcile net income to net cash provided by operations:

Restructuring, net of cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145.4 111.6 38.3

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 328.7 329.3 327.8

Gain before tax on sale of noncore product lines . . . . . . . . . . . . . . . . . . . . . . . . . . . . (46.5) (147.9) (26.7)

Stock-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 116.9 41.1 29.3

Cash effects of changes in:

Receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (116.0) (24.1) (5.6)

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (118.5) (46.8) (76.1)

Accounts payable and other accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149.9 152.7 80.1

Other noncurrent assets and liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.2 17.1 60.1

Net cash provided by operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,821.5 1,784.4 1,754.3

Investing Activities

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (476.4) (389.2) (348.1)

Payment for acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (200.0) (38.5) (800.7)

Sale of noncore product lines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55.0 215.6 37.0

Purchases of marketable securities and investments . . . . . . . . . . . . . . . . . . . . . . . . . . (1.2) (20.0) (127.7)

Proceeds from sales of marketable securities and investments . . . . . . . . . . . . . . . . . . — 10.0 147.3

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.2 1.4 1.8

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (620.4) (220.7) (1,090.4)

Financing Activities

Principal payments on debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,332.0) (2,100.3) (753.9)

Proceeds from issuance of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,471.1 2,021.9 1,246.5

Payments to outside investors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (89.7) —

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (677.8) (607.2) (536.2)

Purchases of treasury shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (884.7) (796.2) (637.9)

Proceeds from exercise of stock options and excess tax benefits . . . . . . . . . . . . . . . . . . 364.4 47.1 70.4

Net cash used in financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,059.0) (1,524.4) (611.1)

Effect of exchange rate changes on cash and cash equivalents . . . . . . . . . . . . . . . . . . 6.7 (18.2) 1.5

Net increase in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 148.8 21.1 54.3

Cash and cash equivalents at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 340.7 319.6 265.3

Cash and cash equivalents at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 489.5 $ 340.7 $ 319.6

Supplemental Cash Flow Information

Income taxes paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 647.9 $ 584.3 $ 593.8

Interest paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168.3 149.9 123.2

Principal payments on ESOP debt, guaranteed by the Company . . . . . . . . . . . . . . . . . . . . 45.0 37.0 29.8

ANALYSIS VIEWPOINT . . . YOU ARE THE INVESTOR

You are considering buying Colgate stock. As part of your preliminary review of Colgate,

you examine its financial statements. What information are you attempting to obtain

from each of these statements to aid in your decision?