Page 52 - Financial Statement Analysis

P. 52

sub79433_ch01.qxd 4/7/08 11:20 AM Page 29

Chapter One | Overview of Financial Statement Analysis 29

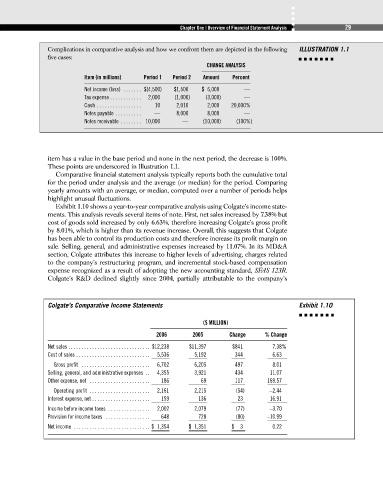

Complications in comparative analysis and how we confront them are depicted in the following ILLUSTRATION 1.1

five cases:

CHANGE ANALYSIS

Item (in millions) Period 1 Period 2 Amount Percent

Net income (loss) . . . . . . . $(4,500) $1,500 $ 6,000 —

Tax expense . . . . . . . . . . . . 2,000 (1,000) (3,000) —

Cash . . . . . . . . . . . . . . . . . 10 2,010 2,000 20,000%

Notes payable . . . . . . . . . . — 8,000 8,000 —

Notes receivable . . . . . . . . 10,000 — (10,000) (100%)

item has a value in the base period and none in the next period, the decrease is 100%.

These points are underscored in Illustration 1.1.

Comparative financial statement analysis typically reports both the cumulative total

for the period under analysis and the average (or median) for the period. Comparing

yearly amounts with an average, or median, computed over a number of periods helps

highlight unusual fluctuations.

Exhibit 1.10 shows a year-to-year comparative analysis using Colgate’s income state-

ments. This analysis reveals several items of note. First, net sales increased by 7.38% but

cost of goods sold increased by only 6.63%, therefore increasing Colgate’s gross profit

by 8.01%, which is higher than its revenue increase. Overall, this suggests that Colgate

has been able to control its production costs and therefore increase its profit margin on

sale. Selling, general, and administrative expenses increased by 11.07%. In its MD&A

section, Colgate attributes this increase to higher levels of advertising, charges related

to the company’s restructuring program, and incremental stock-based compensation

expense recognized as a result of adopting the new accounting standard, SFAS 123R.

Colgate’s R&D declined slightly since 2004, partially attributable to the company’s

Colgate’s Comparative Income Statements Exhibit 1.10

($ MILLION)

2006 2005 Change % Change

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,238 $11,397 $841 7.38%

Cost of sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,536 5,192 344 6.63

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . 6,702 6,205 497 8.01

Selling, general, and administrative expenses . . 4,355 3,921 434 11.07

Other expense, net . . . . . . . . . . . . . . . . . . . . . . . 186 69 117 169.57

Operating profit . . . . . . . . . . . . . . . . . . . . . . . 2,161 2,215 (54) –2.44

Interest expense, net . . . . . . . . . . . . . . . . . . . . . . 159 136 23 16.91

Income before income taxes . . . . . . . . . . . . . . . . 2,002 2,079 (77) –3.70

Provision for income taxes . . . . . . . . . . . . . . . . . 648 728 (80) –10.99

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,354 $ 1,351 $ 3 0.22