Page 57 - Financial Statement Analysis

P. 57

sub79433_ch01.qxd 4/7/08 11:20 AM Page 34

34 Financial Statement Analysis

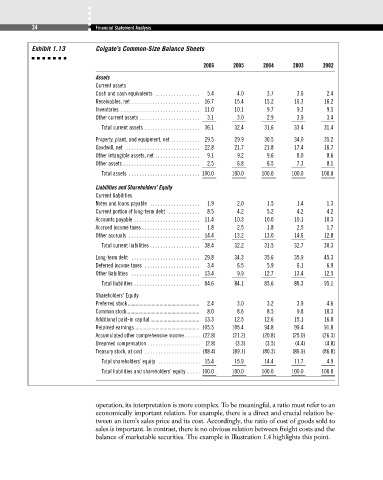

Exhibit 1.13 Colgate’s Common-Size Balance Sheets

2006 2005 2004 2003 2002

Assets

Current assets

Cash and cash equivalents . . . . . . . . . . . . . . . . . 5.4 4.0 3.7 3.6 2.4

Receivables, net . . . . . . . . . . . . . . . . . . . . . . . . . . 16.7 15.4 15.2 16.3 16.2

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.0 10.1 9.7 9.3 9.5

Other current assets . . . . . . . . . . . . . . . . . . . . . . . 3.1 3.0 2.9 3.9 3.4

Total current assets . . . . . . . . . . . . . . . . . . . . . 36.1 32.4 31.6 33.4 31.4

Property, plant, and equipment, net . . . . . . . . . . . 29.5 29.9 30.5 34.0 35.2

Goodwill, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.8 21.7 21.8 17.4 16.7

Other intangible assets, net . . . . . . . . . . . . . . . . . 9.1 9.2 9.6 8.0 8.6

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.5 6.8 6.5 7.3 8.1

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.0 100.0 100.0 100.0 100.0

Liabilities and Shareholders’ Equity

Current liabilities

Notes and loans payable . . . . . . . . . . . . . . . . . . . 1.9 2.0 1.5 1.4 1.3

Current portion of long-term debt . . . . . . . . . . . . 8.5 4.2 5.2 4.2 4.2

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . 11.4 10.3 10.0 10.1 10.3

Accrued income taxes . . . . . . . . . . . . . . . . . . . . . . 1.8 2.5 1.8 2.5 1.7

Other accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.4 13.2 13.0 14.6 12.8

Total current liabilities . . . . . . . . . . . . . . . . . . . 38.4 32.2 31.5 32.7 30.3

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . 29.8 34.3 35.6 35.9 45.3

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . 3.4 6.5 5.9 6.1 6.9

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . 13.4 9.9 12.7 13.4 12.5

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . 84.6 84.1 85.6 88.3 95.1

Shareholders’ Equity

Preferred stock...................................................... 2.4 3.0 3.2 3.9 4.6

Common stock....................................................... 8.0 8.6 8.5 9.8 10.3

Additional paid-in capital..................................... 13.3 12.5 12.6 15.1 16.0

Retained earnings................................................. 105.5 105.4 94.8 99.4 91.8

Accumulated other comprehensive income . . . . . . (22.8) (21.2) (20.8) (25.0) (26.3)

Unearned compensation . . . . . . . . . . . . . . . . . . . . (2.8) (3.3) (3.5) (4.4) (4.8)

Treasury stock, at cost . . . . . . . . . . . . . . . . . . . . . (88.4) (89.1) (80.3) (86.9) (86.8)

Total shareholders’ equity . . . . . . . . . . . . . . . . 15.4 15.9 14.4 11.7 4.9

Total liabilities and shareholders’ equity . . . . . 100.0 100.0 100.0 100.0 100.0

operation, its interpretation is more complex. To be meaningful, a ratio must refer to an

economically important relation. For example, there is a direct and crucial relation be-

tween an item’s sales price and its cost. Accordingly, the ratio of cost of goods sold to

sales is important. In contrast, there is no obvious relation between freight costs and the

balance of marketable securities. The example in Illustration 1.4 highlights this point.