Page 60 - Financial Statement Analysis

P. 60

sub79433_ch01.qxd 4/7/08 11:21 AM Page 37

Chapter One | Overview of Financial Statement Analysis 37

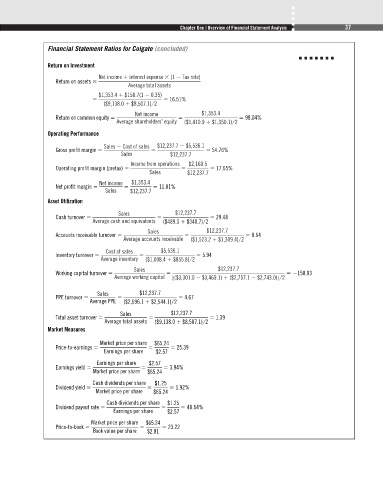

Financial Statement Ratios for Colgate (concluded)

Return on Investment

Net income interest expense (1 Tax rate)

Return on assets

Average total assets

$1,353.4 $158.7(1 0.35)

16.51%

($9,138.0 $8,507.1)N2

Net income $1,353.4

Return on common equity 98.04%

Average shareholders’ equity ($1,410.9 $1,350.1)N2

Operating Performance

Sales Cost of sales $12,237.7 $5,536.1

Gross profit margin 54.76%

Sales $12,237.7

Income from operations $2,160.5

Operating profit margin (pretax) 17.65%

Sales $12,237.7

Net income $1,353.4

Net profit margin 11.01%

Sales $12,237.7

Asset Utilization

Sales $12,237.7

Cash turnover 29.48

Average cash and equivalents ($489.5 $340.7)N2

Sales $12,237.7

Accounts receivable turnover 8.64

Average accounts receivable ($1,523.2 $1,309.4)N2

Cost of sales $5,536.1

Inventory turnover 5.94

Average inventory ($1,008.4 $855.8)N2

Sales $12,237.7

Working capital turnover 158.93

Average working capital [($3,301.0 $3,469.1) ($2,757.1 $2,743.0)]N2

Sales $12,237.7

PPE turnover 4.67

Average PPE ($2,696.1 $2,544.1)N2

Sales $12,237.7

Total asset turnover 1.39

Average total assets ($9,138.0 $8,507.1)N2

Market Measures

Market price per share $65.24

Price-to-earnings 25.39

Earnings per share $2.57

Earnings per share $2.57

Earnings yield 3.94%

Market price per share $65.24

Cash dividends per share $1.25

Dividend yield 1.92%

Market price per share $65.24

Cash dividends per share $1.25

Dividend payout rate 48.64%

Earnings per share $2.57

Market price per share $65.24

Price-to-book 23.22

Book value per share $2.81