Page 142 - Microsoft Word - CAFR Title Page

P. 142

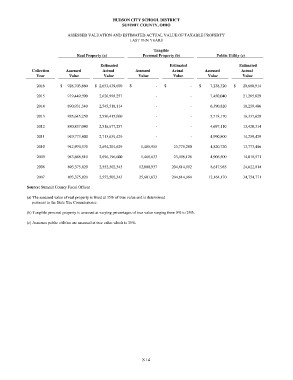

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

ASSESSED VALUATION AND ESTIMATED ACTUAL VALUE OF TAXABLE PROPERTY

LAST TEN YEARS

Real Property (a) Tangible Public Utility (c)

Personal Property (b)

Collection Assessed Estimated Assessed Estimated Assessed Estimated

Year Value Actual Value Actual Value Actual

Value Value Value

2016 $ 928,703,860 $ 2,653,439,600 $ -$ - $ 7,238,320 $ 20,680,914

2015 919,449,390 2,626,998,257 - - 7,450,040 21,285,829

2014 890,931,340 2,545,518,114 - - 6,390,820 18,259,486

2013 885,645,250 2,530,415,000 - - 5,718,170 16,337,629

2012 880,837,040 2,516,677,257 - - 4,697,110 13,420,314

2011 949,773,800 2,713,639,429 - - 4,990,800 14,259,429

2010 942,970,570 2,694,201,629 1,485,955 23,775,280 4,820,720 13,773,486

2009 943,668,810 2,696,196,600 1,468,633 23,498,128 4,906,500 14,018,571

2008 893,375,820 2,552,502,343 12,800,937 204,814,992 8,617,985 24,622,814

2007 893,375,820 2,552,502,343 25,601,873 204,814,984 12,164,170 34,754,771

Source: Summit County Fiscal Officer

(a) The assessed value of real property is fixed at 35% of true value and is determined

pursuant to the State Tax Commissioner.

(b) Tangible personal property is assessed at varying percentages of true value ranging from 0% to 25%.

(c) Assumes public utilities are assessed at true value which is 35%.

S 14