Page 144 - Microsoft Word - CAFR Title Page

P. 144

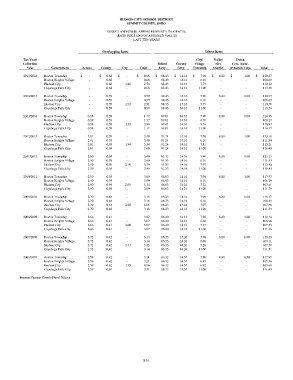

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

DIRECT AND OVERLAPPING PROPERTY TAX RATES

(RATE PER $1,000 OF ASSESSED VALUE)

LAST TEN YEARS

Overlapping Rates Direct Rates

Tax Year/ Government School County City Total School County City/ Valley Union Total

Collection Levy Levy Village Fire Cem. Assoc.

Township District of Boston Twp.

Year

2015/2016 Boston Township $ - $ 0.68 $ - $ 0.68 $ 88.43 $ 14.16 $ 7.98 $ 8.80 $ 1.00 $ 120.37

Boston Heights Village - - 108.69

Hudson City - 0.68 - 0.68 88.43 14.16 6.10 - - 110.32

Cuyahoga Falls City - - 113.59

0.68 1.86 2.54 88.43 14.16 7.73 -

0.68 - 0.68 88.43 14.16 11.00 -

2014/2015 Boston Township - 0.59 - 0.59 88.43 14.16 7.98 8.80 1.00 120.37

Boston Heights Village - - 108.69

Hudson City - 0.59 - 0.59 88.43 14.16 6.10 - - 110.38

Cuyahoga Falls City - - 113.59

0.59 1.92 2.51 88.43 14.16 7.79 -

0.59 - 0.59 88.43 14.16 11.00 -

2013/2014 Boston Township 0.58 0.59 - 1.17 89.01 14.16 7.98 8.80 1.00 120.95

- 109.27

Boston Heights Village 0.58 0.59 - 1.17 89.01 14.16 6.10 - - 110.93

- 114.17

Hudson City 0.58 0.59 1.89 3.06 89.01 14.16 7.76 -

Cuyahoga Falls City 0.58 0.59 - 1.17 89.01 14.16 11.00 -

2012/2013 Boston Township 2.81 0.59 - 3.40 91.24 14.16 7.98 8.80 1.00 123.18

- 111.50

Boston Heights Village 2.81 0.59 - 3.40 91.24 14.16 6.10 - - 113.21

- 116.40

Hudson City 2.81 0.59 1.94 5.34 91.24 14.16 7.81 -

Cuyahoga Falls City 2.81 0.59 - 3.40 91.24 14.16 11.00 -

2011/2012 Boston Township 2.90 0.59 - 3.49 91.33 14.16 7.98 8.80 1.00 123.27

- 111.59

Boston Heights Village 2.90 0.59 - 3.49 91.33 14.16 6.10 - - 113.46

- 116.49

Hudson City 2.90 0.59 2.10 5.59 91.33 14.16 7.97 -

Cuyahoga Falls City 2.90 0.59 - 3.49 91.33 14.16 11.00 -

2010/2011 Boston Township 2.50 0.59 - 3.09 86.03 14.16 7.98 8.80 1.00 117.97

- 106.29

Boston Heights Village 2.50 0.59 - 3.09 86.03 14.16 6.10 - - 107.41

- 111.19

Hudson City 2.50 0.59 2.05 5.14 86.03 14.16 7.22 -

Cuyahoga Falls City 2.50 0.59 - 3.09 86.03 14.16 11.00 -

2009/2010 Boston Township 2.70 0.48 - 3.18 86.23 14.16 7.98 8.80 1.00 118.17

- 106.49

Boston Heights Village 2.70 0.48 - 3.18 86.23 14.16 6.10 - - 107.46

- 111.39

Hudson City 2.70 0.48 1.90 5.08 86.23 14.16 7.07 -

Cuyahoga Falls City 2.70 0.48 - 3.18 86.23 14.16 11.00 -

2008/2009 Boston Township 2.66 0.41 - 3.07 86.20 14.16 7.98 8.80 1.00 118.14

- 106.96

Boston Heights Village 2.66 0.41 - 3.07 86.20 14.16 6.60 - - 107.53

- 111.36

Hudson City 2.66 0.41 2.00 5.07 86.20 14.16 7.17 -

Cuyahoga Falls City 2.66 0.41 - 3.07 86.20 14.16 11.00 -

2007/2008 Boston Township 2.72 0.42 - 3.14 86.25 14.26 7.98 8.80 1.00 118.29

- 107.11

Boston Heights Village 2.72 0.42 - 3.14 86.25 14.26 6.60 - - 107.79

- 111.51

Hudson City 2.72 0.42 2.11 5.25 86.25 14.26 7.28 -

Cuyahoga Falls City 2.72 0.42 - 3.14 86.25 14.26 11.00 -

2006/2007 Boston Township 2.59 0.62 - 3.21 86.12 14.57 7.98 8.80 0.50 117.97

- 107.54

Boston Heights Village 2.59 0.62 - 3.21 86.12 14.57 6.85 - - 107.61

- 111.69

Hudson City 2.59 0.62 1.75 4.96 86.12 14.57 6.92 -

Cuyahoga Falls City 2.59 0.62 - 3.21 86.12 14.57 11.00 -

Source: Summit County Fiscal Officer

S 16